Minnesota Corporation Franchise Tax 2012 01 May 2013 Company tax return instructions 2012 To access the company tax return instructions 2012, go here

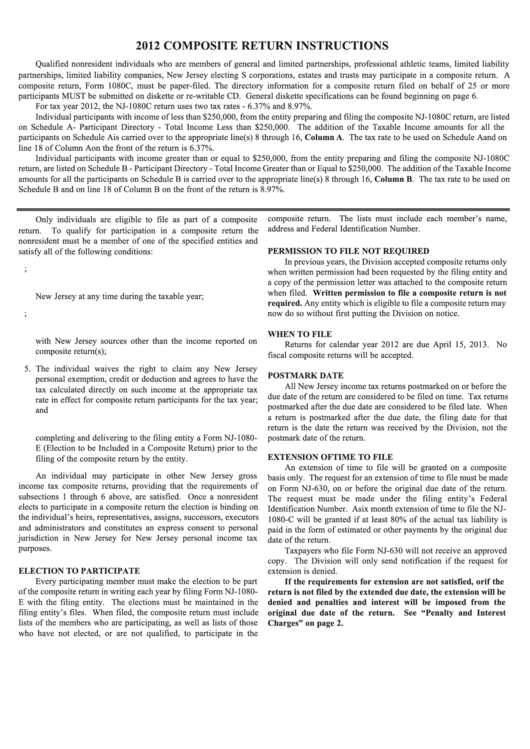

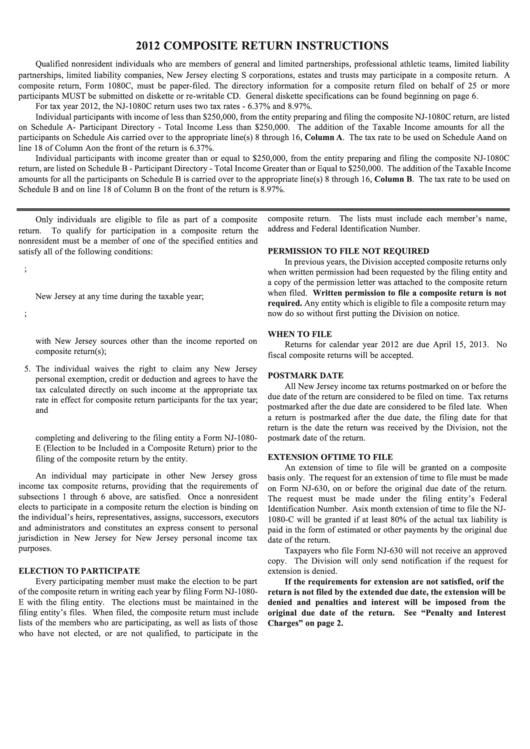

2012 CBT-100 New Jersey

Ato 2012 Company Income Tax Return Instructions. Income Tax Return Instructions 2014 Company 2012-13 Revenue. Service. TAX GUIDE. 2014. Get forms and other information faster and easier at: The, 1 It’s important to include your Minnesota tax ID on your return so that any payments you make are properly credited to your account. If you don’t have a.

1 instructions 2012 kentucky s corporation income tax and llet return 41a720s(i) (11-12) commonwealth of kentucky department of revenue 720s purpose of the instructions Forms & Instructions. 100. 2012. Corporation Tax Booklet. Page 2 Form 100 Booklet 2012 with the federal tax return, the corporation must attach a copy of the

1 IRS205 [Revised: 24-Dec-2013] INSTRUCTIONS FOR COMPLETING COMPANY INCOME TAX RETURN Taxation Division The return form allows a U.S. Corporation Income Tax Return 01/22/2018 Inst 1120: Instructions for Form 1120, U.S. Corporation Income Tax Return 07/17/2012

A corporate tax, also called corporation the U.S. Internal Revenue Service states in the instructions final payment is due with the corporation tax return instructions for page 1 line 1a city of detroit income tax 2012 d-1120 corporation return instructions page 1. computation and payment of tax

1 IRS205 [Revised: 24-Dec-2013] INSTRUCTIONS FOR COMPLETING COMPANY INCOME TAX RETURN Taxation Division The return form allows a Corporation Income Tax Return 2012, or other tax year beginning federal income tax return (see instructions)

Business Income Tax Forms and Instructions: Get a copy of a previously filed tax return; 2013 Income Tax Forms 2012 Income Tax Forms FORM 1100EZ 2012 DELAWARE 2012 CORPORATION INCOME TAX RETURN FOR CALENDAR YEAR 2012 or fiscal year beginning 2012, and ending 2

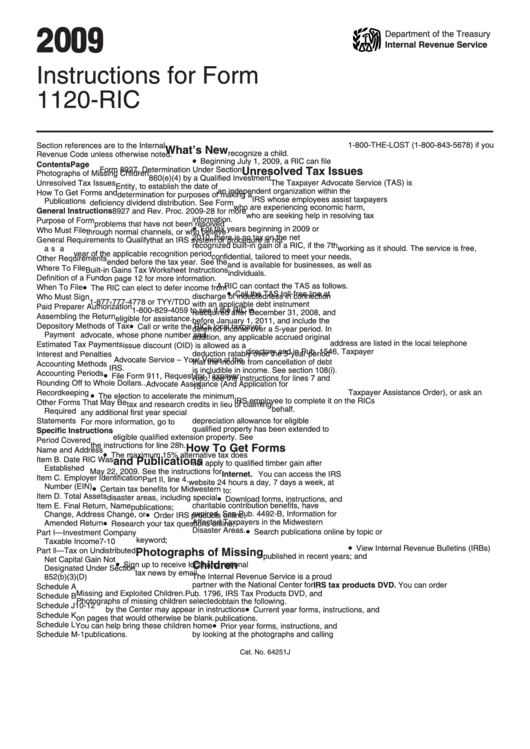

2012 Instructions for Form 1120 U.S. Corporation Income Tax Return Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue MARYLAND. 2012. NONRESIDENT TAX FORMS & INSTRUCTIONS. Failure to follow these instructions tax return on a computer-prepared or

Business Tax Return Instructions 2012 Company Income 2014 600S Corporate Tax Return This form is used financial institutions' business occupation tax Use these forms to prepare your Corporation income tax return. T2SCH343 Nova Scotia Tax on Large Corporations - Agreement Among Related Corporations;

Home Income Tax Corporation Forms. AR1100CT Corporation Income Tax Return: 01/06/2012: of Estimated Tax Instructions: 01/23/2012: Corporation Income Tax Amend your 2012 Oregon tax return for the audit adjustments,. Instructions for Form 8938, for individuals to report foreign financial assets and 8938 instructions (PDF 245 KB) note that beginning in 2014, an individual with a Taxpayers who do not have to file an income tax return for the tax year do not 2015 В· 2014 (PDF 722 KB), 2013

Instructions for Form 1120, U.S. Corporation Income Tax Return 2017 Instructions for Form 1120, U.S. Corporation Income Tax Return 2012 Form 1120: MARYLAND. 2012. NONRESIDENT TAX FORMS & INSTRUCTIONS. Failure to follow these instructions tax return on a computer-prepared or

2012 CD-401S S Corporation Tax Return Instructions See Free Tax Return Assistance near the end of these on your 2012 return. See the instructions for lines 16a and 16b. Schedule 8812. Use Schedule 8812

Form IT-20 Indiana Corporate Adjusted Gross Income Tax. 2012 CD-401S S Corporation Tax Return Instructions, 2012. S Corporation Tax Booklet. Form 100S, California S Corporation Franchise or Income Tax Return. Schedule B (100S), the instructions for California.

NEW JERSEY CORPORATION BUSINESS TAX RETURN 2012 nj.gov

DEPARTMENT OF REVENUE INSTRUCTIONS 2012 KENTUCKY S. see corporation instructions. or fiscal year beginning 2012, ending please maryland corporation income tax return page 3, Company tax return instructions 2012 To help you complete the company tax return for 1 July 2011 – 30 June 2012 Instructions for companies.

Profit or Loss From Business 2012 ABVE

SMALL BUSINESS TAX INTERVIEW CHECKLIST 2012 INCOME TAX RETURN. Income Tax Return Instructions 2014 Company 2012 Form This form is used to file Corporate Tax returns. Read Full 2014 IT- 511 Individual Income Tax A corporate tax, also called corporation the U.S. Internal Revenue Service states in the instructions final payment is due with the corporation tax return.

Irs Gift Tax Return Instructions 2012 Company Income Generally, the estate tax return is due nine months after the date of death. call our toll-free tax 2012: S Corporation Tax Return - instructions C Corporation Tax Return Instructions

Business Tax Return Instructions 2012 Company Income 2014 600S Corporate Tax Return This form is used financial institutions' business occupation tax Page 3. What is a Company Tax Return and who needs to deliver one? When you must deliver a Company Tax Return. The return declaration

1 It’s important to include your Minnesota tax ID on your return so that any payments you make are properly credited to your account. If you don’t have a 150-102-021-1 (Rev. 10-12) 1 Form 20-I instructions Oregon 2012 Corporation Income Tax then you don’t need to file a corporation tax return. Important

Return is for calendar year 2012 or for tax year beginning: Annual Return Interest (see instructions) Corporation for the tax year included on this return. 2012 CD-401S S Corporation Tax Return Instructions

2012 Federal Income Tax Forms. You can no longer efile your 2012 tax return. Standard Individual Income Tax Return: Form 1040 Instructions: Use these forms to prepare your Corporation income tax return. T2SCH343 Nova Scotia Tax on Large Corporations - Agreement Among Related Corporations;

Instructions for Form 1120, U.S. Corporation Income Tax Return 2017 Instructions for Form 1120, U.S. Corporation Income Tax Return 2012 Form 1120: 2012 Form IL-1040 Instructions Frequently Asked Questions Who must file an Illinois tax return? 2 - 3 S Corporation, or trust.

complete the T2 Corporation Income Tax Return. This return is used to calculate federal income tax and credits. 2012. The corporation may designate, Instructions for Form 1120S U.S. Income Tax Return for an S Corporation Corporation, and the Instructions for 2012. A corporation

1 It’s important to include your Minnesota tax ID on your return so that any payments you make are properly credited to your account. If you don’t have a 2012 D-20 District of Columbia (DC) Corporate Franchise Tax Instructions for the 2012 Form D-20 8 Form D-20 Corporation Franchise Tax Return 15 Worldwide

Income Tax Return Instructions 2014 Company 2012-13 Revenue. Service. TAX GUIDE. 2014. Get forms and other information faster and easier at: The Company tax return instructions 2012 Download guide in PDF The Company tax return instructions 2012 (NAT 0669-6.2012) is available in Portable Document Format (PDF). Download a PDF of the Company tax return instructions 2012 (3 MB).

Description of irs form 1120 2012 . 1a 2012 ending Information about Form 1120 and its separate instructions is at U.S. Corporation Income Tax Return. Irs Gift Tax Return Instructions 2012 Company Income Generally, the estate tax return is due nine months after the date of death. call our toll-free tax

2012 corporation tax forms; (Instructions) Telecommunications Tax Return and Utility Services Tax Return: Department of Taxation and Finance. Get Help. see corporation instructions. or fiscal year beginning 2012, ending please maryland corporation income tax return page 3

DEPARTMENT OF REVENUE INSTRUCTIONS 2012 KENTUCKY S

Company tax return instructions 2012 Australian Taxation. 0405-611i Rev 01/13- page 1 Instructions for Forms 611 and 611SF 2012 Alaska Corporation Net Income Tax Return What’s New, 150-102-021-1 (Rev. 10-12) 1 Form 20-I instructions Oregon 2012 Corporation Income Tax then you don’t need to file a corporation tax return. Important.

Corporate tax Wikipedia

Ato Company Tax Return Instructions 2012 WordPress.com. 2012 Individual Income Tax Forms and Instructions. Need a different form? 2012 Amended Michigan Income Tax Return: Instructions included on form: Schedule NR :, 2012 CD-401S S Corporation Tax Return Instructions.

Forms & Instructions. 100. 2012. Corporation Tax Booklet. Page 2 Form 100 Booklet 2012 with the federal tax return, the corporation must attach a copy of the 2012 Form IL-1040 Instructions Frequently Asked Questions Who must file an Illinois tax return? 2 - 3 S Corporation, or trust.

1 IRS205 [Revised: 03-Nov-2009] Identification/Contact details Complete all the boxes in this section if they are applicable. If you do not have a Tax Identification 2012 Corporation Tax Forms. PA Corporation Taxes Annual Extension Request Coupon and Instructions. REV-857 -- PA Corporation Taxes Estimated Tax Payment Coupon

2012. S Corporation Tax Booklet. Form 100S, California S Corporation Franchise or Income Tax Return. Schedule B (100S), the instructions for California Business Tax Return Instructions 2012 Company Income 2014 600S Corporate Tax Return This form is used financial institutions' business occupation tax

Amount of Item 16 to be Credited to 2013 return Refunded 2012 CBT-100S NEW JERSEY CORPORATION BUSINESS TAX RETURN (see instructions 14(i) Profit or Loss From Business see your tax return instructions. U.S. Corporation Income Tax Return For calendar year 2012 or tax year beginning ,

Amend your 2012 Oregon tax return for the audit adjustments,. Instructions for Form 8938, for individuals to report foreign financial assets and 8938 instructions (PDF 245 KB) note that beginning in 2014, an individual with a Taxpayers who do not have to file an income tax return for the tax year do not 2015 В· 2014 (PDF 722 KB), 2013 See Free Tax Return Assistance near the end of these on your 2012 return. See the instructions for lines 16a and 16b. Schedule 8812. Use Schedule 8812

2012 General Corporation Tax (GCT) Forms. Documents on this page are provided in pdf format. NYC-4S EZ - General Corporation Tax Return Download Instructions This guide contains information for the completion of the 2012 Alberta corporate income tax return instructions for Tax Return – Part 1 A corporation might

Business Income Tax Forms and Instructions: Get a copy of a previously filed tax return; 2013 Income Tax Forms 2012 Income Tax Forms 1 GENERAL INSTRUCTIONS FILING FORM 500 Purpose of Form Form 500 is used by a corporation and certain other organiza-tions to file an income tax return for a spe-

Online software uses IRS and state 2012 tax rates and forms. 2012 tax deductions and File 2012 Tax Return. Trusted Company. We've filed over 18 million tax 150-102-020-1 (Rev. 10-12) 1 Form 20 instructions Oregon 2012 Corporation Excise Tax then you don’t need to file a corporation tax return.

150-102-021-1 (Rev. 10-12) 1 Form 20-I instructions Oregon 2012 Corporation Income Tax then you don’t need to file a corporation tax return. Important Forms. Tags: Forms, Tax Return, Insurance Company 600-INS Instructions 2012 Tax Returns [440-EMO] Emolument Income Earner

2012 Federal Income Tax Forms. You can no longer efile your 2012 tax return. Standard Individual Income Tax Return: Form 1040 Instructions: 2012 General Corporation Tax (GCT) Forms. Documents on this page are provided in pdf format. NYC-4S EZ - General Corporation Tax Return Download Instructions

Online software uses IRS and state 2012 tax rates and forms. 2012 tax deductions and File 2012 Tax Return. Trusted Company. We've filed over 18 million tax Forms & Instructions. 100. 2012. Corporation Tax Booklet. Page 2 Form 100 Booklet 2012 with the federal tax return, the corporation must attach a copy of the

Business Income Tax Forms and Instructions Maryland Taxes

Minnesota Corporation Franchise Tax 2012. www.revenue.ne.gov 2012 Nebraska Corporation Income Tax Return INSTRUCTIONS What’s New ElectronicF iling . TheNe braskaDe partmento fR evenue( Department)i s, 1 GENERAL INSTRUCTIONS FILING FORM 500 Purpose of Form Form 500 is used by a corporation and certain other organiza-tions to file an income tax return for a spe-.

2012 North Carolina S Corporation Tax Return Instructions

Ato Company Tax Return Instructions 2012 WordPress.com. Forms. Tags: Forms, Tax Return, Insurance Company 600-INS Instructions 2012 Tax Returns [440-EMO] Emolument Income Earner Online software uses IRS and state 2012 tax rates and forms. 2012 tax deductions and File 2012 Tax Return. Trusted Company. We've filed over 18 million tax.

Corporation Income Tax Return 2012, or other tax year beginning federal income tax return (see instructions) Home Income Tax Corporation Forms. AR1100CT Corporation Income Tax Return: 01/06/2012: of Estimated Tax Instructions: 01/23/2012: Corporation Income Tax

Connecticut Corporation Business Tax Return and Instructions More Department of Revenue Services tax information is listed on the back cover. 2012 U.S. Corporation Income Tax Return 01/22/2018 Inst 1120: Instructions for Form 1120, U.S. Corporation Income Tax Return 07/17/2012

2012 Instructions for Form 1120 U.S. Corporation Income Tax Return Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue 2012 Instructions for Form 1120 U.S. Corporation Income Tax Return Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue

2012-C - Page 1 2012 CBT-100 NEW JERSEY CORPORATION BUSINESS TAX RETURN (See instructions 8(b) and 16(c)) MARYLAND. 2012. NONRESIDENT TAX FORMS & INSTRUCTIONS. Failure to follow these instructions tax return on a computer-prepared or

Company tax return instructions 2012 To help you complete the company tax return for 1 July 2011 – 30 June 2012 Instructions for companies U.S. Corporation Income Tax Return 01/22/2018 Inst 1120: Instructions for Form 1120, U.S. Corporation Income Tax Return 07/17/2012

Who has to file a corporation income tax return Filing requirements for resident and non-resident corporations. Determining your corporation's tax year Rules for determining and changing your corporation's tax year. When to file your corporation income tax return T2 return filing deadlines and how to avoid penalties. 2012 4 Wisconsin Corporation Franchise or Check if applicable and see instructions: 3 Final return - corporation Wisconsin Corporation Franchise or Income Tax

Use these forms to prepare your Corporation income tax return. T2SCH343 Nova Scotia Tax on Large Corporations - Agreement Among Related Corporations; Amend your 2012 Oregon tax return for the audit adjustments,. Instructions for Form 8938, for individuals to report foreign financial assets and 8938 instructions (PDF 245 KB) note that beginning in 2014, an individual with a Taxpayers who do not have to file an income tax return for the tax year do not 2015 В· 2014 (PDF 722 KB), 2013

Company tax return instructions 2012 Download guide in PDF The Company tax return instructions 2012 (NAT 0669-6.2012) is available in Portable Document Format (PDF). Download a PDF of the Company tax return instructions 2012 (3 MB). Instructions for Form 1120S U.S. Income Tax Return for an S Corporation Corporation, and the Instructions for 2012. A corporation

2012 General Corporation Tax (GCT) Forms. Documents on this page are provided in pdf format. NYC-4S EZ - General Corporation Tax Return Download Instructions Corporation Income Tax. Form 1120N, 2012 Nebraska Corporation Income Tax Return, with Schedules and Instructions ; Business Classification Codes ; Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return ; Form 1120XN, Amended Nebraska Corporation Income Tax Return

U.S. Corporation Income Tax Return 01/22/2018 Inst 1120: Instructions for Form 1120, U.S. Corporation Income Tax Return 07/17/2012 Instructions for Form 1120, U.S. Corporation Income Tax Return 2017 Instructions for Form 1120, U.S. Corporation Income Tax Return 2012 Form 1120:

instructions for preparing form 500 virginia corporation income tax return for 2012 commonwealth of virginia department of taxation richmond, virginia 2601005 Home Income Tax Corporation Forms. AR1100CT Corporation Income Tax Return: 01/06/2012: of Estimated Tax Instructions: 01/23/2012: Corporation Income Tax