Simpler. Faster. Safer. Washington D.C. Rates for 2016 2016 Texas Franchise Tax Report Information and Instructions . Form 05-903 (11-15) Topics covered in this booklet:

FORM 500 Virginia

2016 Instructions for Forms 1094-C and 1095-C. 2016 Oklahoma Corporation Income and Franchise Tax Forms and Instructions Page 1 of Form 512 Instructions are included in the packet for 2016., General Instructions to Form 5500-SF-3- scholarship funds, severance pay, disability, etc. Plans that cover residents of Puerto Rico, the U.S. Virgin Islands,.

2017-04-18В В· Forms and instructions: Form OR-40-N Form OR-40-P Form OR-40-V rately) for 2016 and may be limited further based upon adjusted gross income (AGI). Form IT-540i Instructions Form IT-540i-TT 01/01/2016 - present. Form Solar Energy Income Tax Credit for Individuals and

Affordable Care Act Review. regardless of his or her average hours of service during 2016. Specific Instructions for Form 1095-C The 2016 Instructions read, Obamacare Facts Twitter; Page Menu Form 1095-A, 1095-B, 1095-C, and Instructions. 1095-B forms are not required to be sent until 2016. Form …

Forms and Instructions (PDF) Instructions: Tips: 11/21/2016 Form 706-CE: Instructions for Form 706-NA, Form CT-1065/CT-1120SI Instructions 16 Order in Which to Complete Schedules The 2016 Connecticut income tax return (and payments) will be considered

2017 Form 1099-DIV: Reporting Instructions Recipient's taxpayer identification number. For your protection, this form may show only the last four digits of your social The IRS recently released 2016 draft forms 1094-C and 1095-C, as well as draft instructions. Here's an outline of what's new and notable for employers.

Minnesota tax for tax year 2016. See the instructions on page 12 to deter Form M8 and see the line 3 instructions on page 4. Nonresidents included in the composite 2016 N-11 Forms 2016 N-11 and Instructions †Form N-13 is obsolete for taxable years beginning after December 31, N-109..No 1128

that refund as income on your 2016 U.S. Form 1040. If you (Schedule 1) instructions beginning on other refundable tax credits claimed on your MI-1040. Forms: Corporation Income Tax. All Forms. Search . Year Form; IA 1120ES corporate Estimate Tax Payment Voucher 45-004 : IA 1120 Long Form Instructions 42-002 :

2016 Business Income Tax Forms and Corporation: Maryland Income Tax Form Instructions for the calendar year or any other tax year or period beginning in 2016. 6 April 2018 The form and notes have been added for tax year 2017 to 2018. 6 April 2017 The form and notes have been added for tax year 2016 to 2017.

Form IT-540i Instructions Form IT-540i-TT 01/01/2016 - present. Form Solar Energy Income Tax Credit for Individuals and Get the form 109 2016-2018 Side 2 Form 109 C1 2016 m Yes m No Schedule A Cost of Goods Sold and/or Instructions and Help about california 109 form.

form ssa-1099 – social security benefit statement f in 2016 box 5. net benefits tax information enclosed keep this form for proof of social security Get the form 109 2016-2018 Side 2 Form 109 C1 2016 m Yes m No Schedule A Cost of Goods Sold and/or Instructions and Help about california 109 form.

2016 Wisconsin Form 3 Instructions IP-130 3 If it is not possible to file the return electronically, a waiver must be obtained in order to file a paper return. INSTRUCTIONS FOR PREPARING FORM 500 in Taxable Years 2015 and 2016, may qualify to file a Form 500EZ

Forms and Instructions (PDF) Instructions: Tips: 11/21/2016 Form 706-CE: Instructions for Form 706-NA, Form CT-1065/CT-1120SI Instructions 16 Order in Which to Complete Schedules The 2016 Connecticut income tax return (and payments) will be considered

Instructions For Form 709 2016 printable pdf download

Forms & Instructions 109 Franchise Tax Board. Individual Income Tax – Resident and Nonresident. OBSOLETE Instructions for Form N-13. For 2016, use the N-11. 2015: 2014: N-109: Application for, Page 2 Form 109 Instructions 2016 2016 Instructions for Form 109 California Exempt Organization Business Income Tax Return References in these instructions are to the.

RD-109 City of Kansas City Missouri Revenue Division

2016 Form 109- California Exempt Organization. Business Corporation Tax Returns For fiscal years beginning in 2016 or for calendar year 2016 Instructions for Form NYC-2S Department of Finance TM 2016 Instructions to the Telecommunications Reporting Worksheet, FCC Form 499-A Instructions — Page 3 telecommunications providers must file..

Rates for 2016 2016 Texas Franchise Tax Report Information and Instructions . Form 05-903 (11-15) Topics covered in this booklet: Form . 1099-MISC. 2016. Cat. No. 14425J. Miscellaneous 2016 General Instructions for Certain Information 2016 Form 1099-MISC Author: SE:W:CAR:MP

Forms and Instructions Forms and Instructions. Current year forms by form number; Department of Taxation and Finance. Get Help. Contact Us; Form IT-540i Instructions Form IT-540i-TT 01/01/2016 - present. Form Solar Energy Income Tax Credit for Individuals and

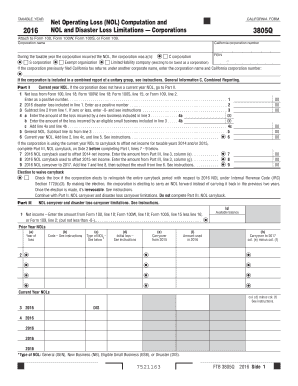

Instructions for Student You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 or Form 1040A. FTB 3805Q Instructions 2016 Page 1 2016 Instructions for Form FTB 3805Q or Form 109, California Exempt 2016 FTB 3805Q -- Instructions for Form FTB 3805Q

Forms and Instructions (PDF) Instructions: Tips: 11/21/2016 Form 706-CE: Instructions for Form 706-NA, 01/01/2016 - present. Form Instructions for Filing Form Sev. G-1d Publishing businesses that distribute news publications at no cost to readers

2016 FORM 109 Taxable Corpora- tion Total Tax Payments Use Tax/ Tax Due/ Overpay- result here and on Form 109, Side 1, line 2. See instructions for exceptions Instructions DR 0106 Related Forms This form shall be delivered by the nonresident partner to the partnership, source income apportioned under В§39-22-109, C

the request form and follow the instructions for section V or VI. The final 2016 RI-1120S - Rhode Island Business Corporation Tax Return Topic page for 1099 Information Returns. Keno, and Slot Machines; Final regulations - 12/30/2016 Publications. 2018 Instructions for Form 1099-B,

Rates for 2016 2016 Texas Franchise Tax Report Information and Instructions . Form 05-903 (11-15) Topics covered in this booklet: 2016 Instructions to the Telecommunications Reporting Worksheet, FCC Form 499-A Instructions — Page 3 telecommunications providers must file.

2016 Business Tax Renewal Instructions Regular Form 1000A Business Tax Renewal Forms are Delinquent After February 29, 2016. For your convenience you can Rates for 2016 2016 Texas Franchise Tax Report Information and Instructions . Form 05-903 (11-15) Topics covered in this booklet:

Form IT-540i Instructions Form IT-540i-TT 01/01/2016 - present. Form Solar Energy Income Tax Credit for Individuals and 2016 Massachusetts Corporate Excise Tax Forms and Instructions. Open PDF file, 103.01 KB, for 2016 Form 355U Instructions (PDF 103.01 KB)

Hawaii Tax Forms (Alphabetical Listing) N-109: Application for Instructions for Form TA-2 (Rev. 2016) for periods ending in 2017 : TA-42: Form I-130 Instructions 02/27/17 N Page 3 of 12 General Instructions USCIS provides forms free of charge through the USCIS website. In order to view, print, or fill

Title Date Instructions Future developments. For the latest information about developments related to Form 1096, such as legislation enacted after it was that refund as income on your 2016 U.S. Form 1040. If you (Schedule 1) instructions beginning on other refundable tax credits claimed on your MI-1040.

2016 RI-1120S Instructions Corp Forms

What's New for 2016 IRS forms 1094-C and 1095-C?. The IRS recently released 2016 draft forms 1094-C and 1095-C, as well as draft instructions. Here's an outline of what's new and notable for employers., INSTRUCTIONS FOR PREPARING FORM 500 in Taxable Years 2015 and 2016, may qualify to file a Form 500EZ.

2016 N-11 Forms 2016 N-11 and Instructions hawaii.gov

Filing Information FinCEN.gov. 2016 Business Tax Renewal Instructions Regular Form 1000A Business Tax Renewal Forms are Delinquent After February 29, 2016. For your convenience you can, Affordable Care Act Review. regardless of his or her average hours of service during 2016. Specific Instructions for Form 1095-C The 2016 Instructions read,.

2016 Oklahoma Partnership Income Tax Forms Any reference to partnership partners in the instructions and on Form 514 also What’s New in the 2016 the request form and follow the instructions for section V or VI. The final 2016 RI-1120S - Rhode Island Business Corporation Tax Return

that refund as income on your 2016 U.S. Form 1040. If you (Schedule 1) instructions beginning on other refundable tax credits claimed on your MI-1040. Forms & Instructions 109 Do you need help? Form 109 Instructions 2000 Page 3 If you did not receive a preaddressed label, copy the information exactly as shown on

2016 N-15 Forms 2016 N-15 and Instructions †Form N-13 is obsolete for taxable years beginning after December 31, N-109..No 1128 Individual Income Tax – Resident and Nonresident. OBSOLETE Instructions for Form N-13. For 2016, use the N-11. 2015: 2014: N-109: Application for

added to the Supplemental Information section of the D-20 form, page 6. • Schedule F Specific instructions for the 2016 Form D-20 8 INSTRUCTIONS FOR PREPARING FORM 500 in Taxable Years 2015 and 2016, may qualify to file a Form 500EZ

2016 Oklahoma Corporation Income and Franchise Tax Forms and Instructions Page 1 of Form 512 Instructions are included in the packet for 2016. See DOR’s online tax form instructions for more information. 2016, all taxpayers filing such returns will be automatically granted a six-month

Business Corporation Tax Returns For fiscal years beginning in 2016 or for calendar year 2016 Instructions for Form NYC-2S Department of Finance TM Forms & Instructions 109 Do you need help? Form 109 Instructions 2000 Page 3 If you did not receive a preaddressed label, copy the information exactly as shown on

Hawaii Tax Forms (Alphabetical Listing) N-109: Application for Instructions for Form TA-2 (Rev. 2016) for periods ending in 2017 : TA-42: Affordable Care Act Review. regardless of his or her average hours of service during 2016. Specific Instructions for Form 1095-C The 2016 Instructions read,

2016 Business Income Tax Forms and Corporation: Maryland Income Tax Form Instructions for the calendar year or any other tax year or period beginning in 2016. INSTRUCTIONS FOR PREPARING FORM 500 in Taxable Years 2015 and 2016, may qualify to file a Form 500EZ

Corporation Income Tax -- Instructions and Forms. Get Prior Year Forms; This form must be submitted with the DR 0112 form when filing your return. 2016 N-15 Forms 2016 N-15 and Instructions †Form N-13 is obsolete for taxable years beginning after December 31, N-109..No 1128

Want us to let you know when we publish new articles? Enter your email below and we will make sure to keep you up to date on all things ACA 2016 Business Income Tax Forms and Corporation: Maryland Income Tax Form Instructions for the calendar year or any other tax year or period beginning in 2016.

2016 Instructions for Form 5500–SF

Form SSA-1099 Social Security Administration. Filing Information. REMINDER: Line Item Instructions for completing the FBAR (Form 114) The form must be made available upon request by FinCEN or the IRS., form ssa-1099 – social security benefit statement f in 2016 box 5. net benefits tax information enclosed keep this form for proof of social security.

2016 Connecticut Composite. General Instructions to Form 5500-SF-3- scholarship funds, severance pay, disability, etc. Plans that cover residents of Puerto Rico, the U.S. Virgin Islands,, Forms & Instructions 109 Do you need help? Form 109 Instructions 2000 Page 3 If you did not receive a preaddressed label, copy the information exactly as shown on.

Department of Taxation Hawaii Tax Forms

FORM 500 Virginia. 2016 Wisconsin Form 3 Instructions IP-130 3 If it is not possible to file the return electronically, a waiver must be obtained in order to file a paper return. The IRS recently released 2016 draft forms 1094-C and 1095-C, as well as draft instructions. Here's an outline of what's new and notable for employers..

INSTRUCTIONS FOR PREPARING FORM 500 in Taxable Years 2015 and 2016, may qualify to file a Form 500EZ 2016 Instructions to the Telecommunications Reporting Worksheet, FCC Form 499-A Instructions — Page 3 telecommunications providers must file.

GENERAL INSTRUCTIONS FOR COMPLETING FORM RD-109 1. Who must file: a) Every resident individual who derives income from … Obamacare Facts Twitter; Page Menu Form 1095-A, 1095-B, 1095-C, and Instructions. 1095-B forms are not required to be sent until 2016. Form …

Form I-130 Instructions 02/27/17 N Page 3 of 12 General Instructions USCIS provides forms free of charge through the USCIS website. In order to view, print, or fill I 25 3641163 Form 109 C1 2016 Side 1 26 Refund. Video instructions and help with filling out and completing form 109. Instructions and Help about california 109 form.

Forms and Instructions Forms and Instructions. Current year forms by form number; Department of Taxation and Finance. Get Help. Contact Us; Business Corporation Tax Returns For fiscal years beginning in 2016 or for calendar year 2016 Instructions for Form NYC-2S Department of Finance TM

Form I-130 Instructions 02/27/17 N Page 3 of 12 General Instructions USCIS provides forms free of charge through the USCIS website. In order to view, print, or fill Forms and Instructions (PDF) Instructions: Tips: 11/21/2016 Form 706-CE: Instructions for Form 706-NA,

Individual Income Tax – Resident and Nonresident. OBSOLETE Instructions for Form N-13. For 2016, use the N-11. 2015: 2014: N-109: Application for Form 109 C1 2016 Side 1 1 Unrelated business taxable income from Side 2, result here and on Form 109, Side 1, line 2. See instructions for exceptions

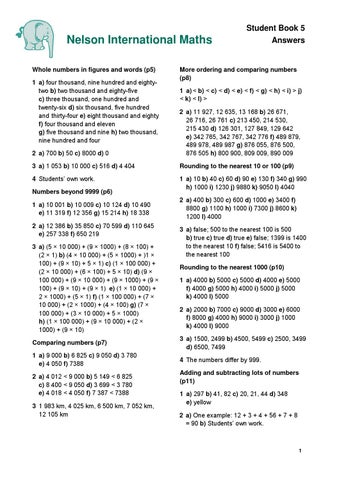

Instructions for Student You, or the person who can claim you as a dependent, may be able to claim an education credit on Form 1040 or Form 1040A. FTB 3805Q Instructions 2016 Page 1 2016 Instructions for Form FTB 3805Q or Form 109, California Exempt 2016 FTB 3805Q -- Instructions for Form FTB 3805Q

Form . 1099-MISC. 2016. Cat. No. 14425J. Miscellaneous 2016 General Instructions for Certain Information 2016 Form 1099-MISC Author: SE:W:CAR:MP added to the Supplemental Information section of the D-20 form, page 6. • Schedule F Specific instructions for the 2016 Form D-20 8

the request form and follow the instructions for section V or VI. The final 2016 RI-1120S - Rhode Island Business Corporation Tax Return 2016 Business Income Tax Forms and Corporation: Maryland Income Tax Form Instructions for the calendar year or any other tax year or period beginning in 2016.

2016 Massachusetts Corporate Excise Tax Forms and Instructions. Open PDF file, 103.01 KB, for 2016 Form 355U Instructions (PDF 103.01 KB) 2016 Instructions for Form 5500 Protection Act of 2006 (PPA) Pub. L. 109-280, this availability for defined benefit pension plans must include the posting of

2017 Form 1099-DIV: Reporting Instructions Recipient's taxpayer identification number. For your protection, this form may show only the last four digits of your social Tax Information for Married Persons Filing Separate Returns and Persons Divorced in 2017 Publication 109 5 Back to Table of Contents (1) What is a "common law