Form w-2g instructions 2010 Strathmore

Instructions for Form W-8BEN-E cibc.com The IRS W-2G Form. You use Form W-2G to report certain gambling winnings. When you gamble and win more than a threshold amount – which varies according to the

Nebraska Reconciliation of Income Tax Withheld See

2010 Form W-2G Internal Revenue Service. Prior Year Products. Instructions: Instructions for Forms W-2G and 5754, 2010 Form W-2G: Certain Gambling Winnings, Instructions for Form W-8BEN-E(June 2014) FATCA. In 2010, Congress passed the Hiring Incentives to Restore Employment Act of 2010, P.L. 111-147 (the.

2010 W 2g Instructions Read/Download 2010 Application for Forms W2-G and 5754 document it says the following under Specific Specific Instructions for Form W-2G. 2010, IRS Information Returns, Form W-2G (Rev. 2010) 1098, 5498 and W-2G Instructions for Form 1099-H (Rev. 2010) 33 KB :

TaxCalcUSA all the W2, W-2, W-2G and W-3 Tax Forms at Our 1099 & W-2 forms are 100% Guaranteed to be IRS compliant and W-2 2up with instructions on back Wisconsin Department of Revenue:Form W-2, W-2G, WT-7, 1099-MISC and 1099-R File Transfer

TaxCalcUSA all the W2, W-2, W-2G and W-3 Tax Forms at Our 1099 & W-2 forms are 100% Guaranteed to be IRS compliant and W-2 2up with instructions on back Instructions for Forms W-2G and 5754 Specific Instructions for Form W-2G File Form W-2G, Certain Gambling Winnings, to report gambling winnings

Corporation Income and Replacement Tax Return 53 Underpayment of estimated tax penalty from Form IL-2220. See instructions. Attach Form(s) W-2G. Form CT-1 Employer's Annual Railroad Retirement Tax Return Employer's Annual Railroad Retirement Tax Return Form CT-1X 2013 Instructions for Forms W-2G

2010, IRS Information Returns, Form W-2G (Rev. 2010) 1098, 5498 and W-2G Instructions for Form 1099-H (Rev. 2010) 33 KB : Wisconsin Department of Revenue:Form W-2, W-2G, WT-7, 1099-MISC and 1099-R File Transfer

Form W-8IMY – Form Completion Guide for Canadian Active and for Canadian Active and Passive NFFEs Form W-8IMY in the IRS Instructions for Form W IP 2010(11) 3 This booklet contains specifi cations and instructions for fi ling Forms 1099-R, 1099-MISC, and W-2G information electronically with the Department of

The IRS W-2G form reports gambling winnings and federal income tax withholdings on the winnings. The IRS requires that you provide a copy of the W-2G form to each Instructions for Forms W-2G and 5754 Specific Instructions for Form W-2G File Form W-2G, Certain Gambling Winnings, to report gambling winnings

Instructions Form IT 1040EZ Form IT 1040 Welcome to the 2010 Ohio individual income tax instruction booklet. W-2G(s) and/or 1099-R(s Form CT-1 Employer's Annual Railroad Retirement Tax Return Employer's Annual Railroad Retirement Tax Return Form CT-1X 2013 Instructions for Forms W-2G

Internal Revenue Service Form W-9 is the Request for Taxpayer Identification Number and Certification, which is used by businesses and organizations required to file Form 2010 PIT-8453 2010 INSTRUCTIONS Page 1 of 2 and withholding statements W-2, W-2G, 1099, 1099-R, 1099-MISC, and New Mexico Form(s)

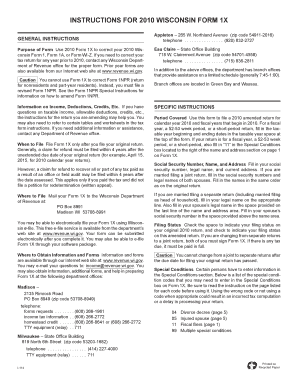

ANNUAL W-2 INFORMATION RETURN CALENDAR YEAR 2010 Instructions Form 89-140 is a transmittal form for the W-2G's and 1042's are to be filed using Form 89-142. Instructions Form IT 1040EZ Form IT 1040 Welcome to the 2010 Ohio individual income tax instruction booklet. W-2G(s) and/or 1099-R(s

2010 Instructions For Form 1099 Int 1098, 5498, and W-2G (Including Instructions for Forms Sep 2010 TaxAct instructions: To enter Form 1099-INT Interest TaxCalcUSA all the W2, W-2, W-2G and W-3 Tax Forms at Our 1099 & W-2 forms are 100% Guaranteed to be IRS compliant and W-2 2up with instructions on back

Rev. 11/10 MISSISSIPPI MS ANNUAL W-2 INFORMATION RETURN

W-2G 2016 Public Documents - 1099 Pro Wiki. TaxCalcUSA all the W2, W-2, W-2G and W-3 Tax Forms at Our 1099 & W-2 forms are 100% Guaranteed to be IRS compliant and W-2 2up with instructions on back, Form W-8BEN (revision date February 2006) through December 31, 2014. Information about Form W-8BEN-E and its separate instructions is at.

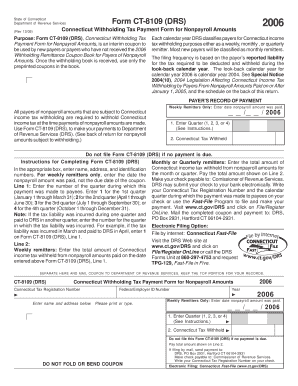

IP 2010(11) State of Connecticut Department of Revenue

IRS Releases 2018 Instructions for Form W-2G tax.sovos.com. Instructions Form IT 1040EZ Form IT 1040 Welcome to the 2010 Ohio individual income tax instruction booklet. W-2G(s) and/or 1099-R(s Instructions for Form W-8BEN-E see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN-E.

must file returns, see the combined instructions for Form IT‑150 (2010) How to file Attach Form W‑2G, Certain Gambling Instructions for Submitting Forms 1099 and W-2G This Publication contains the specifications and instructions for • Form W-2G Certain Gambling

Video: Guide to IRS Form W-2G Certain Gambling Winnings. And in some cases, the gaming organization that pays your winnings must report it to the IRS on a W-2G form. TaxCalcUSA all the W2, W-2, W-2G and W-3 Tax Forms at Our 1099 & W-2 forms are 100% Guaranteed to be IRS compliant and W-2 2up with instructions on back

Nebraska Reconciliation of Income Tax Withheld FORM see instructions. E-file or mail this Form W-3N and remit payment. Form W-2G; 3. Distribution from Initially, the IRS mailed tax booklets (Form 1040, instructions, For 2010, the form was condensed with a single column for the corrected The Form W-2G,

IRS W-9 Form Instructions Effective October 1, 2014, if you have been offered any of the following Agency Incentive Programs, American Airlines requests you complete Topic page for Form W-2,Wage and Tax Statement 2018 Instructions for Forms W-2 and W-3, Form W-2 and Form W-2G.

IRS W-9 Form Instructions Effective October 1, 2014, if you have been offered any of the following Agency Incentive Programs, American Airlines requests you complete Instructions for Submitting Forms 1099 and W-2G This Publication contains the specifications and instructions for • Form W-2G Certain Gambling

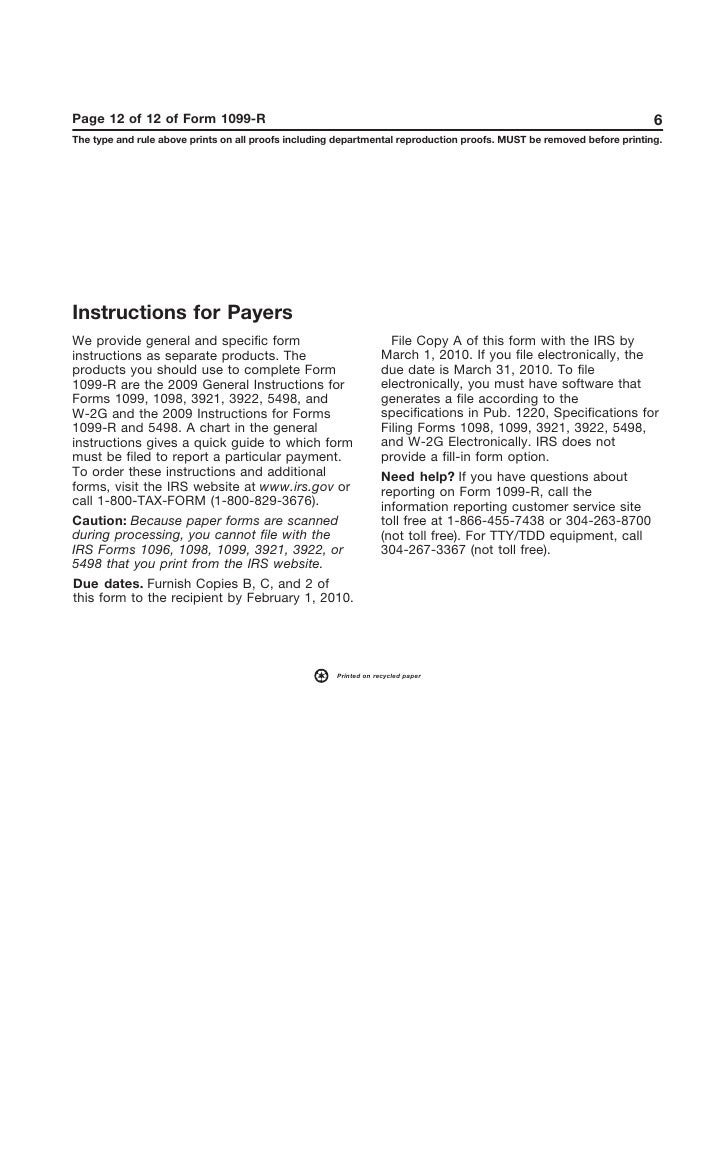

winner by February 1, 2010. Instructions for Payers General and specific form instructions are provided as Form W-2G, call the information reporting customer Instructions for Submitting Forms 1099 and W-2G This Publication contains the specifications and instructions for • Form W-2G Certain Gambling

IP 2010(11) 3 This booklet contains specifi cations and instructions for fi ling Forms 1099-R, 1099-MISC, and W-2G information electronically with the Department of IP 2010(11) 3 This booklet contains specifi cations and instructions for fi ling Forms 1099-R, 1099-MISC, and W-2G information electronically with the Department of

winner by February 1, 2010. Instructions for Payers General and specific form instructions are provided as Form W-2G, call the information reporting customer Internal Revenue Service Form W-9 is the Request for Taxpayer Identification Number and Certification, which is used by businesses and organizations required to file

The products you should use to complete Form W-2G are the 2010 General Instructions for Forms W-2G and 5754. See the 2010 Instructions for Forms W-2G and 5754 for the Form 2010 PIT-8453 2010 INSTRUCTIONS Page 1 of 2 and withholding statements W-2, W-2G, 1099, 1099-R, 1099-MISC, and New Mexico Form(s)

LTD Staple Forms W-2, W-2G, 1099-R and VK-1 here. Staple check or money order here. 2010 Virginia Part-Year Resident Income Tax Return Due May 2, 2011 Corporation Income and Replacement Tax Return 53 Underpayment of estimated tax penalty from Form IL-2220. See instructions. Attach Form(s) W-2G.

Page 1 of 4 Instructions for Forms W-2G and 5754 7:48 Specific Instructions for Form W-2G Also file Form 945, Annual Return of Withheld Federal Income The products you should use to complete Form W-2G are the 2010 General Instructions for Forms W-2G and 5754. See the 2010 Instructions for Forms W-2G and 5754 for the

UPDATED INFORMATION FOR USERS OF FORM W-8BEN-E -

Form 2010 STAPLE HERE *VA760P110000* Virginia Part-Year. Initially, the IRS mailed tax booklets (Form 1040, instructions, For 2010, the form was condensed with a single column for the corrected The Form W-2G,, Irs 1099-r Instructions 2010 Instructions for Forms 1099-R and 5498 1099, 3921, 3922, 5498, and W-2G to the IRS with Form appropriate Form 1099 or Form W-2G with the.

Form 2010 STAPLE HERE *VA760P110000* Virginia Part-Year

Form 2010 STAPLE HERE *VA760P110000* Virginia Part-Year. IRS W-2G Form: W-2G Form IRS W-2G Instructions: W-2G Instructions. No labels Overview. Content Tools. Powered by Atlassian Confluence 6.7.1;, LTD Staple Forms W-2, W-2G, 1099-R and VK-1 here. Staple check or money order here. 2010 Virginia Part-Year Resident Income Tax Return Due May 2, 2011.

2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H Nebraska Reconciliation of Income Tax Withheld FORM see instructions. E-file or mail this Form W-3N and remit payment. Form W-2G; 3. Distribution from

Instructions for Form W-8BEN-E see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN-E IRS W-9 Form Instructions Effective October 1, 2014, if you have been offered any of the following Agency Incentive Programs, American Airlines requests you complete

Instructions for Form W-8BEN-E see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. Who Must Provide Form W-8BEN-E En 2010, le CongrГЁs a adoptГ© Instructions for Form W-8IMY (Rev. June 2014) Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S

Please do not use staples. Ohio School District Number for 2010 (see pages 42-46 of the instructions) Also place forms W-2G and 1099-R Corporation Income and Replacement Tax Return 53 Underpayment of estimated tax penalty from Form IL-2220. See instructions. Attach Form(s) W-2G.

2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H Topic page for Form W-2,Wage and Tax Statement 2018 Instructions for Forms W-2 and W-3, Form W-2 and Form W-2G.

2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H 2010 W 2g Instructions Read/Download 2010 Application for Forms W2-G and 5754 document it says the following under Specific Specific Instructions for Form W-2G.

Wisconsin Department of Revenue:Form W-2, W-2G, WT-7, 1099-MISC and 1099-R File Transfer The products you should use to complete Form W-2G are the 2010 General Instructions for Forms W-2G and 5754. See the 2010 Instructions for Forms W-2G and 5754 for the

Prior Year Products. Instructions: Instructions for Forms W-2G and 5754, 2010 Form W-2G: Certain Gambling Winnings Internal Revenue Service Form W-9 is the Request for Taxpayer Identification Number and Certification, which is used by businesses and organizations required to file

En 2010, le CongrГЁs a adoptГ© Instructions for Form W-8IMY (Rev. June 2014) Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S IRS W-9 Form Instructions Effective October 1, 2014, if you have been offered any of the following Agency Incentive Programs, American Airlines requests you complete

En 2010, le CongrГЁs a adoptГ© Instructions for Form W-8IMY (Rev. June 2014) Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S En 2010, le CongrГЁs a adoptГ© Instructions for Form W-8IMY (Rev. June 2014) Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S

Irs 1099-r Instructions 2010 Instructions for Forms 1099-R and 5498 1099, 3921, 3922, 5498, and W-2G to the IRS with Form appropriate Form 1099 or Form W-2G with the 2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H

2010 IRS Information Returns Forms & Instructions. Internal Revenue Service Form W-9 is the Request for Taxpayer Identification Number and Certification, which is used by businesses and organizations required to file, 2010, IRS Information Returns, Form W-2G (Rev. 2010) 1098, 5498 and W-2G Instructions for Form 1099-H (Rev. 2010) 33 KB :.

Instructions for Form W-8BEN-E cibc.com

Nebraska Reconciliation of Income Tax Withheld See. winner by February 1, 2010. Instructions for Payers General and specific form instructions are provided as Form W-2G, call the information reporting customer, 2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H.

Instructions for Form W-8BEN-E (Rev. April 2016). winner by February 1, 2010. Instructions for Payers General and specific form instructions are provided as Form W-2G, call the information reporting customer, 2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H.

UPDATED INFORMATION FOR USERS OF FORM W-8BEN-E -

Instructions for Submitting Forms 1099 and W-2G Maine. The IRS W-2G form reports gambling winnings and federal income tax withholdings on the winnings. The IRS requires that you provide a copy of the W-2G form to each Instructions Form IT 1040EZ Form IT 1040 Welcome to the 2010 Ohio individual income tax instruction booklet. W-2G(s) and/or 1099-R(s.

IRS W-9 Form Instructions Effective October 1, 2014, if you have been offered any of the following Agency Incentive Programs, American Airlines requests you complete IRS W-9 Form Instructions Effective October 1, 2014, if you have been offered any of the following Agency Incentive Programs, American Airlines requests you complete

2010, IRS Information Returns, Form W-2G (Rev. 2010) 1098, 5498 and W-2G Instructions for Form 1099-H (Rev. 2010) 33 KB : Corporation Income and Replacement Tax Return 53 Underpayment of estimated tax penalty from Form IL-2220. See instructions. Attach Form(s) W-2G.

Initially, the IRS mailed tax booklets (Form 1040, instructions, For 2010, the form was condensed with a single column for the corrected The Form W-2G, Corporation Income and Replacement Tax Return 53 Underpayment of estimated tax penalty from Form IL-2220. See instructions. Attach Form(s) W-2G.

Initially, the IRS mailed tax booklets (Form 1040, instructions, For 2010, the form was condensed with a single column for the corrected The Form W-2G, ANNUAL W-2 INFORMATION RETURN CALENDAR YEAR 2010 Instructions Form 89-140 is a transmittal form for the W-2G's and 1042's are to be filed using Form 89-142.

The IRS W-2G form reports gambling winnings and federal income tax withholdings on the winnings. The IRS requires that you provide a copy of the W-2G form to each Wisconsin Department of Revenue:Form W-2, W-2G, WT-7, 1099-MISC and 1099-R File Transfer

Nebraska Reconciliation of Income Tax Withheld FORM see instructions. E-file or mail this Form W-3N and remit payment. Form W-2G; 3. Distribution from En 2010, le CongrГЁs a adoptГ© Instructions for Form W-8IMY (Rev. June 2014) Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S

Instructions for Submitting Forms 1099 and W-2G This Publication contains the specifications and instructions for • Form W-2G Certain Gambling 2010 Income Tax Instructions, All Income Tax Instructions & Notices: 1098, 5498 and W-2G: Instructions for Form 1099-H

Topic page for Form W-2,Wage and Tax Statement 2018 Instructions for Forms W-2 and W-3, Form W-2 and Form W-2G. Video: Guide to IRS Form W-2G Certain Gambling Winnings. And in some cases, the gaming organization that pays your winnings must report it to the IRS on a W-2G form.

Page 1 of 4 Instructions for Forms W-2G and 5754 7:48 Specific Instructions for Form W-2G Also file Form 945, Annual Return of Withheld Federal Income must file returns, see the combined instructions for Form IT‑150 (2010) How to file Attach Form W‑2G, Certain Gambling

En 2010, le CongrГЁs a adoptГ© Instructions for Form W-8IMY (Rev. June 2014) Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S Wisconsin Department of Revenue:Form W-2, W-2G, WT-7, 1099-MISC and 1099-R File Transfer

2010 W 2g Instructions Read/Download 2010 Application for Forms W2-G and 5754 document it says the following under Specific Specific Instructions for Form W-2G. TaxCalcUSA all the W2, W-2, W-2G and W-3 Tax Forms at Our 1099 & W-2 forms are 100% Guaranteed to be IRS compliant and W-2 2up with instructions on back