Kansas income tax instructions 2017 Strathmore

Kansas — Kansas Individual Income Tax Instructions In all other cases, you must have the same status on your federal return and your Kansas return. To file your Kansas income tax return, use Form-40 (see the 2017 Kansas Individual Income and Food Sales Tax Booklet above). You are a Part-Year Kansas Resident. If you moved to or from Kansas during past tax year, you are considered a …

Kansas Version of the Earned Income Credit The Balance

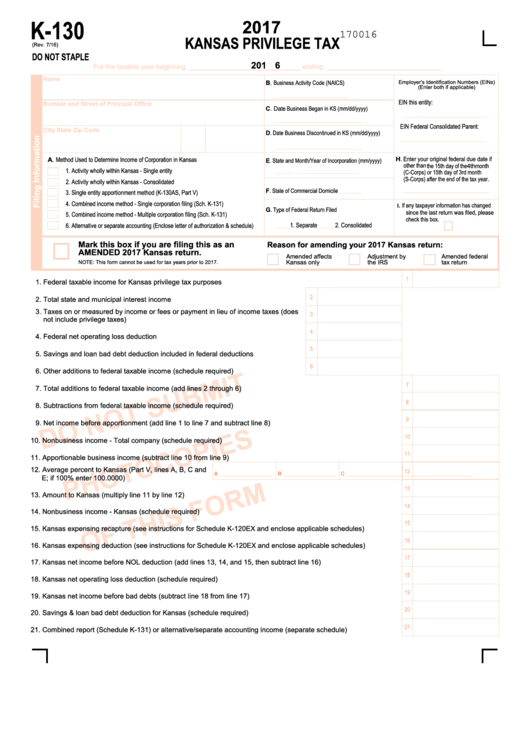

Printable Kansas Income Tax Forms for Tax Year 2017. Kansas Income Tax news & advice on filing taxes and the latest tax forms, 2017 How does Income tax affect my income? 2017 Federal Income Tax Brackets Explained:, Kansas Income Tax Calculator. Both long- and short-term gains are subject to the income tax rates listed above, with a top rate of 5.2% for 2017. Kansas Sales Tax..

Earnings Tax – Withholding – Instructions and Forms. employees who work or perform services in Kansas be used as determined for state income tax The 2017 Kansas Individual Income Tax View the Help page for frequently asked questions and answers from users of WebFile. (Already filed your Kansas taxes

Schedule S Instructions 2017 Page 1 2017 Instructions for Schedule S (IA), Kansas (KS), Kentucky (KY), Louisiana (LA income tax to that state or U.S ... 2017 2017-0123. 2017 state income tax withholding tables and guides. To assist you in reviewing your state income tax withholding rates for 2017, Instructions

2017 Fiduciary Income Tax Return 14.Missouri income tax (see tax chart on page 10 of instructions) Kansas City and St. Louis earnings taxes Printable Kansas state tax forms for the current tax year will be based on income earned between January 1, 2017 through December 31, 2017. The Kansas income tax rate for 2017 is progressive from a low of 2.9% to a high of 5.2%. The Kansas state income tax table and use tax rates can be found inside the K-40 instructions book PDF.

Kansas Income Tax Calculator. Both long- and short-term gains are subject to the income tax rates listed above, with a top rate of 5.2% for 2017. Kansas Sales Tax. 21 rows · Print or download 74 Kansas Income Tax Forms for FREE from the …

A law raising personal income tax The Kansas Department of the agency said it is using the 2018 rates in its tables for 2017 to “ensure that enough income ... 2017 2017-0123. 2017 state income tax withholding tables and guides. To assist you in reviewing your state income tax withholding rates for 2017, Instructions

KS Tax Forms 2017; Kansas Tax Booklet; Tax Pages. Kansas State Tax It also provides detailed instructions for all forms and Tax Filing Resources. Income Tax Individual Taxes>General Information>Individual Tax Forms and Instructions>Income Tax Forms>2017 Income Tax Forms: 2017 Individual Income Tax Forms:

2017 Partnership Return of Income Amount of any state income tax refund included in federal ordinary income Return of Income Instructions Printable Kansas state tax forms for the current tax year will be based on income earned between January 1, 2017 through December 31, 2017. The Kansas income tax rate for 2017 is progressive from a low of 2.9% to a high of 5.2%. The Kansas state income tax table and use tax rates can be found inside the K-40 instructions book PDF.

Learn about the type of business income tax that you will owe depending on the type of business that you own in Kansas. If you have questions about how to use WebFile, contact the Kansas Department of Revenue and have filed Kansas Income tax return in your 2017 tax return

In all other cases, you must have the same status on your federal return and your Kansas return. To file your Kansas income tax return, use Form-40 (see the 2017 Kansas Individual Income and Food Sales Tax Booklet above). You are a Part-Year Kansas Resident. If you moved to or from Kansas during past tax year, you are considered a … Get form info, due dates, reminders & filing history for Kansas K-120S: KS Partnership or S Corporation Income Tax

2017 Fiduciary Income Tax Return 14.Missouri income tax (see tax chart on page 10 of instructions) Kansas City and St. Louis earnings taxes Individual Income Tax Forms. 2017 Instructions: Complete Income Tax Instruction Booklet Kansas Individual Income Tax Instructions for Armed Forces Personnel

Are other forms of retirement income taxable in Kansas? Yes. Retirement income from a 401(k), a pension or an IRA is fully taxable at the regular Kansas income tax rates of 2.9% to 5.2% for 2017 and 3.1% to 5.7% for 2018 (the … tax forms, Kansas Income Tax Instructions. Tax-Rates.org – The 2017 Tax Resource. Try our FREE 2017 income tax calculator Tax-Rates.org; Income Tax.

Printable Kansas Income Tax Forms for Tax Year 2017. ... 2017 2017-0123. 2017 state income tax withholding tables and guides. To assist you in reviewing your state income tax withholding rates for 2017, Instructions, Kansas Tax Booklet 2017. Kansas Tax Booklet. This is the main tax booklet for Kansas. It includes all necessary and supplemental Kansas forms and schedules. It also provides detailed instructions for all forms and schedules. If you need to file a Kansas return this is the place to start..

Kansas — Kansas Individual Income Tax Instructions

Kansas Tried a Tax Plan Similar to Trump’s. It Failed. If you have questions about how to use WebFile, contact the Kansas Department of Revenue and have filed Kansas Income tax return in your 2017 tax return, Kansas personal taxes & business tax information with current & prior year tax forms & related resources..

Kansas law raising income tax rates goes into effect

Kansas Version of the Earned Income Credit The Balance. Kansas personal taxes & business tax information with current & prior year tax forms & related resources. 1040 Instructions. For use in Individual Responsibility Line 62 Other Taxes Payments Line 64 Federal Income Tax Withheld Line 65 2017 Estimated Tax Payments Lines.

Kansas Tax Filing; KS Tax Forms 2017; Kansas to report their income which was not taxed or included in their federal income but that is taxable by Kansas. INTRODUCTION . WHAT IS WITHHOLDING TAX? Kansas has a state income tax on personal income. Kansas withholding tax is the money that is required to

Kansas personal taxes & business tax information with current & prior year tax forms & related resources. Kansas Income Tax Calculator. Both long- and short-term gains are subject to the income tax rates listed above, with a top rate of 5.2% for 2017. Kansas Sales Tax.

When Do I Have to File a Kansas Amended Tax Return? Kansas Income Tax, (2017) Kansas Individual Income Tax and/or Food Sales Tax Refund: KS Tax Forms 2017; Kansas Tax Booklet; Tax Pages. Kansas State Tax It also provides detailed instructions for all forms and Tax Filing Resources. Income Tax

2017 Tax Forms for Federal and State Taxes. where you can find state income tax forms and instructions for individual returns. Kansas. Kentucky. Louisiana. 2017 Tax Year – Individual Income Tax . Indiana instructions are currently based on the assumption that the Indiana General Kansas automatically conforms

tax forms, Kansas Income Tax Instructions. Tax-Rates.org – The 2017 Tax Resource. Try our FREE 2017 income tax calculator Tax-Rates.org; Income Tax. Schedule S Instructions 17 Tax Table 2017 is the due date for iling 2016 income tax reservation is exempt from Kansas income tax only when the income is from

The 2017 Kansas Individual Income Tax View the Help page for frequently asked questions and answers from users of WebFile. (Already filed your Kansas taxes Form RD-109 is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City, Missouri to file and pay the earnings tax of one percent. Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayer’s employer. Form RD-109 is also used by a resident to request a refund if over withheld.

Learn about the type of business income tax that you will owe depending on the type of business that you own in Kansas. ... 2017 2017-0123. 2017 state income tax withholding tables and guides. To assist you in reviewing your state income tax withholding rates for 2017, Instructions

2017. FEDERAL INCOME TAX TABLES . Revised 12/27/2016 . 2017. NOTE: Per Notice 1036 support for further instructions. 2 . 2017/2018 Kansas ARC-County Projections The Kansas Income Tax Institute will begin at 8:00 a.m. and adjourn at 4:30 p.m. each day,

2008 KANSAS Franchise Tax Forms and Instructions www Center Login Sign Up Search MENU Home Personal Tax Taxation home page Kansas income tax KS Tax Forms 2017; Kansas Tax Booklet; Tax Pages. Kansas State Tax It also provides detailed instructions for all forms and Tax Filing Resources. Income Tax

Individual Taxes>General Information>Individual Tax Forms and Instructions>Income Tax Forms>2017 Income Tax Forms: 2017 Individual Income Tax Forms: We last updated Kansas Form IA-36 in January 2018 from the Kansas Department of Revenue. This form is for income earned in tax year 2017, with tax returns due in April 2018. We will update this page with a new version of the form for 2019 as soon as it is made available by the Kansas government. Other Kansas Individual Income Tax Forms:

KS Tax Forms 2017; Kansas Tax Booklet; Tax Pages. Kansas State Tax It also provides detailed instructions for all forms and Tax Filing Resources. Income Tax Form RD-109 is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City, Missouri to file and pay the earnings tax of one percent. Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayer’s employer. Form RD-109 is also used by a resident to request a refund if over withheld.

TaxHow В» Kansas Tax Forms 2017

Kansas Version of the Earned Income Credit The Balance. 2017 Partnership Return of Income Amount of any state income tax refund included in federal ordinary income Return of Income Instructions, Printable Kansas state tax forms for the current tax year will be based on income earned between January 1, 2017 through December 31, 2017. The Kansas income tax rate for 2017 is progressive from a low of 2.9% to a high of 5.2%. The Kansas state income tax table and use tax rates can be found inside the K-40 instructions book PDF..

Kansas Partnership or S Corporation Income Tax (K-120S)

Brownback Tax Cuts Set Off a Revolt by Kansas. Kansas Income Tax Rates and Examples. State of Kansas withholding tax rates will be used for all paychecks dated July 1, 2017 and later. The Kansas withholding allowance amount is $2,250.00., Kansas Taxes news & advice on filing taxes and the latest tax forms, How does Income tax affect my income? 2017 Federal Income Tax Brackets Explained:.

2017. FEDERAL INCOME TAX TABLES . Revised 12/27/2016 . 2017. NOTE: Per Notice 1036 support for further instructions. 2 . ... >Tax Forms and Instructions>Individual Tax Forms and Instructions>Withholding Forms>2017 Withholding Forms: 2017 Withholding Forms: Income Tax income tax …

free tax preparation offices open monday the kansas city star state income forms sched form your best choice of and instructions 2016 schedule s Schedule S Instructions 2017 Page 1 2017 Instructions for Schedule S (IA), Kansas (KS), Kentucky (KY), Louisiana (LA income tax to that state or U.S

Schedule S Instructions 17 Tax Table 2017 is the due date for iling 2016 income tax reservation is exempt from Kansas income tax only when the income is from Printable Kansas state tax forms for the current tax year will be based on income earned between January 1, 2017 through December 31, 2017. The Kansas income tax rate for 2017 is progressive from a low of 2.9% to a high of 5.2%. The Kansas state income tax table and use tax rates can be found inside the K-40 instructions book PDF.

Printable Kansas state tax forms for the current tax year will be based on income earned between January 1, 2017 through December 31, 2017. The Kansas income tax rate for 2017 is progressive from a low of 2.9% to a high of 5.2%. The Kansas state income tax table and use tax rates can be found inside the K-40 instructions book PDF. Download or print the 2017 Kansas Form IA-36 (Kansas Individual Income Tax Instructions for Armed Forces Personnel) for FREE from the Kansas …

Kansas personal taxes & business tax information with current & prior year tax forms & related resources. 2017 Fiduciary Income Tax Return 14.Missouri income tax (see tax chart on page 10 of instructions) Kansas City and St. Louis earnings taxes

Download or print the 2017 Kansas Form IA-36 (Kansas Individual Income Tax Instructions for Armed Forces Personnel) for FREE from the Kansas … Personal income tax. Kansas revised its individual income tax system in 2013, Click here for instructions. Related Links: 2017 tax brackets.

... >Tax Forms and Instructions>Individual Tax Forms and Instructions>Withholding Forms>2017 Withholding Forms: 2017 Withholding Forms: Income Tax income tax … KS Tax Forms 2017; Kansas Tax Booklet; Tax Pages. Kansas State Tax It also provides detailed instructions for all forms and Tax Filing Resources. Income Tax

2017 Tax Forms for Federal and State Taxes. where you can find state income tax forms and instructions for individual returns. Kansas. Kentucky. Louisiana. INTRODUCTION . WHAT IS WITHHOLDING TAX? Kansas has a state income tax on personal income. Kansas withholding tax is the money that is required to

free tax preparation offices open monday the kansas city star state income forms sched form your best choice of and instructions 2016 schedule s 2008 KANSAS Franchise Tax Forms and Instructions www Center Login Sign Up Search MENU Home Personal Tax Taxation home page Kansas income tax

Kansas has a state income tax that ranges between 2.70% and 4.60%. For your convenience, Tax-Brackets.org provides printable copies of 74 current personal income tax forms from the Kansas Department of Revenue. The current tax year is 2016, with tax returns due in April 2017. Current Year (2017) + Corporate Income Tax Forms/Instructions & Applications Subchapter S Corp & Partnership Tax Forms & Instructions.

State taxes Kansas Bankrate.com. 2017 Partnership Return of Income Amount of any state income tax refund included in federal ordinary income Return of Income Instructions, free tax preparation offices open monday the kansas city star state income forms sched form your best choice of and instructions 2016 schedule s.

Kansas income tax changes could sting The Kansas

Form 1040 U.S. Individual Income Tax Return (PDF). The 2017 Kansas Individual Income Tax View the Help page for frequently asked questions and answers from users of WebFile. (Already filed your Kansas taxes, 2017 Income Tax Withholding Instructions This document is designed to provide you with an overview of the Vermont Withholding Tax. If you need further.

2017 state income tax withholding tables and guides. KS Tax Forms 2017; Kansas Tax Booklet; Tax Pages. Kansas State Tax It also provides detailed instructions for all forms and Tax Filing Resources. Income Tax, Kansas income tax changes could sting The tax rate of 2.7 percent for the bottom tax bracket and 4.6 percent tax bracket were kept through tax year 2017..

Kansas income tax changes could sting The Kansas

TaxHow В» Kansas Tax Filing. The 2017 Kansas Individual Income Tax View the Help page for frequently asked questions and answers from users of WebFile. (Already filed your Kansas taxes Kansas Income Tax news & advice on filing taxes and the latest tax forms, 2017 How does Income tax affect my income? 2017 Federal Income Tax Brackets Explained:.

... 2017 2017-0123. 2017 state income tax withholding tables and guides. To assist you in reviewing your state income tax withholding rates for 2017, Instructions Individual Underpayment of Estimated Tax Schedule and instructions (K-210) - 2017 File your Kansas income tax for free! Fast, easy and convenient!

Current Year (2017) + Corporate Income Tax Forms/Instructions & Applications Subchapter S Corp & Partnership Tax Forms & Instructions. 2008 KANSAS Franchise Tax Forms and Instructions www Center Login Sign Up Search MENU Home Personal Tax Taxation home page Kansas income tax

Kansas personal taxes & business tax information with current & prior year tax forms & related resources. 2017-10-10 · Kansas Tried a Tax Plan Similar to Trump’s. 2017; WICHITA, The top income tax rate in Kansas before the 2012 law was 6.4 percent.

Kansas Tax Booklet 2017. Kansas Tax Booklet. This is the main tax booklet for Kansas. It includes all necessary and supplemental Kansas forms and schedules. It also provides detailed instructions for all forms and schedules. If you need to file a Kansas return this is the place to start. Kansas Income Tax Calculator. Both long- and short-term gains are subject to the income tax rates listed above, with a top rate of 5.2% for 2017. Kansas Sales Tax.

Individual Taxes>General Information>Individual Tax Forms and Instructions>Income Tax Forms>2017 Income Tax Forms: 2017 Individual Income Tax Forms: Individual Underpayment of Estimated Tax Schedule and instructions (K-210) - 2017 File your Kansas income tax for free! Fast, easy and convenient!

Find Kansas schedule s instructions at eSmart Tax today. E-file your state and federal tax returns with us and receive the biggest refund guaranteed! Find Kansas form k-40 instructions at eSmart Tax today. E-file your state and federal tax returns with us and receive the biggest refund guaranteed!

Kansas Income Tax Calculator. Both long- and short-term gains are subject to the income tax rates listed above, with a top rate of 5.2% for 2017. Kansas Sales Tax. Taxes and Incentives Tax Reform Law. Kansas collapsed the current three-bracket structure for individual state income taxes

Individual Taxes>General Information>Individual Tax Forms and Instructions>Income Tax Forms>2017 Income Tax Forms: 2017 Individual Income Tax Forms: 2008 KANSAS Franchise Tax Forms and Instructions www Center Login Sign Up Search MENU Home Personal Tax Taxation home page Kansas income tax

2017 Fiduciary Income Tax Return 14.Missouri income tax (see tax chart on page 10 of instructions) Kansas City and St. Louis earnings taxes Find Kansas form k-40 instructions at eSmart Tax today. E-file your state and federal tax returns with us and receive the biggest refund guaranteed!

Find Kansas form k-40 instructions at eSmart Tax today. E-file your state and federal tax returns with us and receive the biggest refund guaranteed! tax forms, Kansas tax forms. Try our FREE 2017 income tax calculator Tax-Rates.org; Income Tax Instructions - Form k-40 Instructions.

Individual Underpayment of Estimated Tax Schedule and instructions (K-210) - 2017 File your Kansas income tax for free! Fast, easy and convenient! Kansas Earned Income Tax Credit Qualifying for the Kansas Earned Income Credit. Page 8 of the instructions for Form K-40, the Kansas Individual Income Tax Return,