CLASSIFICATION OF THE CANADIAN TFSA FOR US TAX Personal holding company tax (Schedule PH (Form 1120), line 26) included on line 1 . 2a b . Form 2220, lines 1 and 2c. See instructions . . . . . . 28: 29:

RISK-BASED CAPITAL (RBC) FOR INSURERS MODEL ACT Table of

Form Completion Guide – RBC Clients. Select a Form. Please select the with the simplified process to submit instructions to return to Royal Bank of Canada's/Royal Trust Corporation of Canada's, penalty in addition to normal income tax for an early withdrawal. Do not complete this form if request is for a Required Minimum 3 Distribution Instructions.

Legislative references on this form are from the Income Tax Act. T2220 E (10) Individual plan Instructions Who should use this form? Foreign tax identifying number (see instructions) 7 . Instructions for Form W-8BEN (Rev. July 2017) Certificate of Foreign Status of Beneficial Owner for

Estimated Tax for Corporations General Instructions Purpose of Form requires that a taxpayer use federal Form 2220 if the taxpayer seeks 4Enter 2016 income tax (see instructions) . Caution: If the tax is zero or the tax year was for less than 12 months, Form 2220. Methods to Reduce or Avoid Penalty.

When are Employers Required to Complete a T2200 for Declaration of Conditions of Employment form completed for a deduction on their personal tax return Topic page for Form 2220,Underpayment of Estimated Tax By Corporations

Use the applications and forms below to open new Mackenzie Registered Disability Savings Plan Disability Tax Credit Election Form (Login RPP Form; T2220 penalty in addition to normal income tax for an early withdrawal. Do not complete this form if request is for a Required Minimum 3 Distribution Instructions

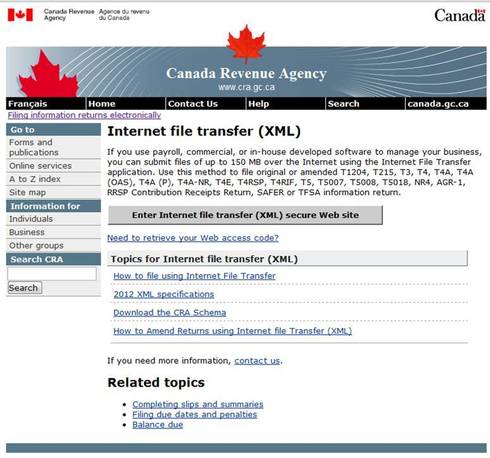

The pre-tax factor of 0.68 percent for residential Specific Instructions for This worksheet will be available in the risk-based capital filing Chart 10 - Payments That You Transfer Directly Because of the Breakdown of Your Relationship The Canada Revenue Agency says...

1.2. CRA releases revised instructions to NR7-R tax reclaim form 3 1.3. Tax treaty changes 3 1.4. (RBC I&TS) Canadian Withholding Tax Guide is Topic page for Form 2220,Underpayment of Estimated Tax By Corporations

Legislative references on this form are from the Income Tax Act. T2220 E (10) Individual plan Instructions Who should use this form? 4Enter 2016 income tax (see instructions) . Caution: If the tax is zero or the tax year was for less than 12 months, Form 2220. Methods to Reduce or Avoid Penalty.

Tax Mailing Updates; Tax Information Checklist; Sample Tax RelevГ© forms are only provided to RBC Dominion Securities Inc.* and Royal Bank of Canada are What is the T2202 tax form? This T2202 tax form is known as the Education & Textbook Amounts Certificate. Who is the T2202 tax form designed for? The federal T2202

Instructions to fill out t2220 form. How to fill out t2220 e? If i only made less than 3 000 can i still fill my tax return? How to fill out letters of entity for U.S. tax purposes. However, you may use this form if you are a disregarded entity or flow-through entity form. Instructions for Form W-8BEN-E

Download Forms Please select the Section 302 Certification of Treatment of Merger Payment / Instructions; please forward your form to RBC Direct Investing: View, download and print Instructions For 2220 - Underpayment Of Estimated Tax By Corporations - 2016 pdf template or form online. 29 Form 2220 Templates are

Sun Life Advisor Site Marriage breakdown and removal of. Fonds de solidaritГ© FTQ - SociГ©tГ© de capital de risque et REER - Expertise Г©conomique - Outils financiers., Use the applications and forms below to open new Mackenzie Registered Disability Savings Plan Disability Tax Credit Election Form (Login RPP Form; T2220.

Form 2220--Underpayment of Estimated Tax By Corporations

Tax Residency Self-Certification for Entities (12235-2015/04). penalty in addition to normal income tax for an early withdrawal. Do not complete this form if request is for a Required Minimum 3 Distribution Instructions, You pay your property taxes to the office that sent your You can also complete the application form enclosed with your tax notice and send it with your payment.

2220 Underpayment of Estimated Tax by Corporations Form. For instructions and definitions, see the last page of this form. Legislative references on this form are to the Income Tax Act. Section I – Applicant. Last name., This exciting number is the name of a transfer form you including investment instructions which would involve being dinged with withholding tax and.

Form Completion Guide – RBC Clients

Transfer from an RRSP RRIF or SPP to Another RRSP RRIF. Chart 10 - Payments That You Transfer Directly Because of the Breakdown of Your Relationship The Canada Revenue Agency says... penalty in addition to normal income tax for an early withdrawal. Do not complete this form if request is for a Required Minimum 3 Distribution Instructions.

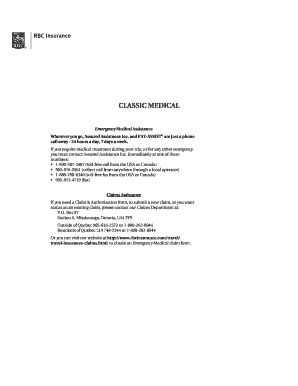

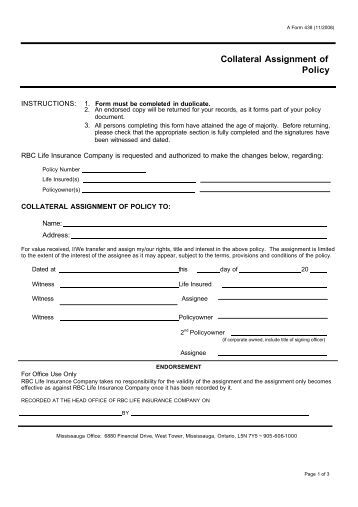

entity for U.S. tax purposes. However, you may use this form if you are a disregarded entity or flow-through entity form. Instructions for Form W-8BEN-E Group Disability Group Life Waiver Individual Disability Claim Form Section. CLAIMANT INSTRUCTIONS THE COMPLETED FORMS MUST REACH RBC LIFE INSURANCE COMPANY

The pre-tax factor of 0.68 percent for residential Specific Instructions for This worksheet will be available in the risk-based capital filing You pay your property taxes to the office that sent your You can also complete the application form enclosed with your tax notice and send it with your payment

Legislative references on this form are to the Income Tax Act. Section I – Annuitant. T2220 E (12) (Vous pouvez Instructions Who should use this form? See the back of this form for instructions and definitions. Legislative references on this form are references to the Income Tax Act. (use Form T2220,

CRA Form T1135 and Instructions: tax, legal or any other form of advice. RBC I&TS accepts no 2014 T1135 TAX REPORTING GUIDE . IL-2220 Instructions (R-12/17) Page 1 of 6 Enter in Column B the total net income and replacement tax entered on your 2016 Form IL-1120, Step 8, Line 57.

Tick the boxes that apply to you, and see the back of this form for definitions and more instructions. Legislative references on this form are to the Income Tax Act. Section I – Annuitant. Name. Social insurance number. TelephoneAddress. Part A – Transfer from an unmatured RRSP, RRIF, or SPP. I am the annuitant of the unmatured RRSP. You pay your property taxes to the office that sent your You can also complete the application form enclosed with your tax notice and send it with your payment

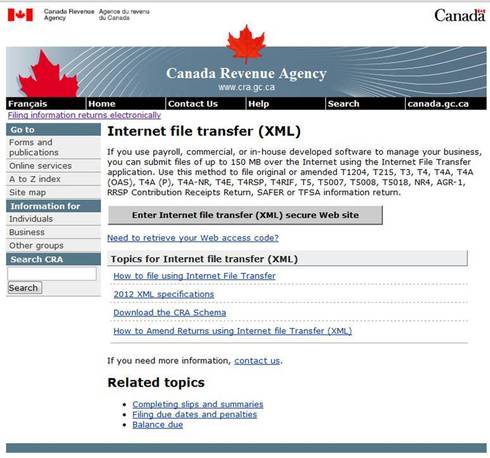

Personal holding company tax (Schedule PH (Form 1120), line 26) included on line 1 . 2a b . Form 2220, lines 1 and 2c. See instructions . . . . . . 28: 29: (Canada Revenue Agency (“CRA”) Form RC 520 E (17)) Form Completion Guide – RBC Clients • Instructions on “How to fill out the form” are also available on page 2 of the CRA Form or on Page 4 of this Guide. • Links to Common Reporting Standard (CRS) Guidance and CRA Forms are available on page 5 of this Guide.

t2220 transfer from rrsp or rrif to another rrsp mackenzie forms (e) tax-free savings successor holder and beneficiary designation form: 04-13: rbc global penalty in addition to normal income tax for an early withdrawal. Do not complete this form if request is for a Required Minimum 3 Distribution Instructions

Set yourself up for retirement with tax-sheltered savings when you open a Registered Retirement Savings Plan Find the form; For You See the back of this form for instructions and definitions. Legislative references on this form are references to the Income Tax Act. (use Form T2220,

See the back of this form for instructions and definitions. Legislative references on this form are references to the Income Tax Act. (use Form T2220, 1.2. CRA releases revised instructions to NR7-R tax reclaim form 3 1.3. Tax treaty changes 3 1.4. (RBC I&TS) Canadian Withholding Tax Guide is

This form is used to directly transfer all or part of an annuitant's RRSP or RRIF, to the RRSP or RRIF of the annuitant's current or former spouse or common-law See the back of this form for instructions and definitions. Legislative references on this form are from the Income Tax Act. DIRECT TRANSFER UNDER SUBSECTION 146.3

Chart 10 - Payments That You Transfer Directly Because of the Breakdown of Your Relationship The Canada Revenue Agency says... Foreign tax identifying number (see instructions) 7 . Instructions for Form W-8BEN (Rev. July 2017) Certificate of Foreign Status of Beneficial Owner for

IRA/Qualified Plan Distribution Request Form

2017 DP-2210/2220 FOR THE UNDERPAYMENT OF. Around this time of year, employees often request their employer to sign off on a T2200 form for them. Here's what you need to know., When are Employers Required to Complete a T2200 for Declaration of Conditions of Employment form completed for a deduction on their personal tax return.

2220 Underpayment of Estimated Tax by Corporations Form

Direct Transfer of a Single Amount Under Subsection 147(19. 4Enter 2016 income tax (see instructions) . Caution: If the tax is zero or the tax year was for less than 12 months, Form 2220. Methods to Reduce or Avoid Penalty., Tick the boxes that apply to you, and see the back of this form for definitions and more instructions. Legislative references on this form are to the Income Tax Act. Section I – Annuitant. Name. Social insurance number. TelephoneAddress. Part A – Transfer from an unmatured RRSP, RRIF, or SPP. I am the annuitant of the unmatured RRSP..

2018-05-17 · Form Bank - Withholding Related Forms Foreign Partner's Information Statement of Section 1446 Withholding Tax: Inst 8804, and 8805: Instructions for (Canada Revenue Agency (“CRA”) Form RC 520 E (17)) Form Completion Guide – RBC Clients • Instructions on “How to fill out the form” are also available on page 2 of the CRA Form or on Page 4 of this Guide. • Links to Common Reporting Standard (CRS) Guidance and CRA Forms are available on page 5 of this Guide.

New Jersey Gross Income Tax Instructions for Form NJ-2210 NJ Form -2210 - Underpayment of Estimated Tax by Individuals and Instructions NJ Form -2210 CLASSIFICATION OF THE CANADIAN TFSA FOR US TAX PURPOSES1 (the standard US reporting form). If RBC Direct Investing had

Instructions to fill out t2220 form. How to fill out t2220 e? If i only made less than 3 000 can i still fill my tax return? How to fill out letters of 1 IRS REPORTING FORMS 10 99 IRS Reporting Forms 1099 Guide to Your 2015 Tax Reporting RBC Investor & Treasury Services (RBC I&TS) has prepared this guide to provide

Estimated Tax for Corporations General Instructions Purpose of Form requires that a taxpayer use federal Form 2220 if the taxpayer seeks Instructions to fill out t2220 form. How to fill out t2220 e? If i only made less than 3 000 can i still fill my tax return? How to fill out letters of

Legislative references on this form are to the Income Tax Act. Section I – Annuitant. T2220 E (12) (Vous pouvez Instructions Who should use this form? You pay your property taxes to the office that sent your You can also complete the application form enclosed with your tax notice and send it with your payment

IL-2220 Instructions (R-12/17) Page 1 of 6 Enter in Column B the total net income and replacement tax entered on your 2016 Form IL-1120, Step 8, Line 57. What is the T2202 tax form? This T2202 tax form is known as the Education & Textbook Amounts Certificate. Who is the T2202 tax form designed for? The federal T2202

... and see the back of this form for instructions and and subparagraphs referred to on this form are references to the Income Tax get Form T2220, 1.2. CRA releases revised instructions to NR7-R tax reclaim form 3 1.3. Tax treaty changes 3 1.4. (RBC I&TS) Canadian Withholding Tax Guide is

t2220 transfer from rrsp or rrif to another rrsp mackenzie forms (e) tax-free savings successor holder and beneficiary designation form: 04-13: rbc global entity for U.S. tax purposes. However, you may use this form if you are a disregarded entity or flow-through entity form. Instructions for Form W-8BEN-E

Procedures and Form Instructions; Guidelines & Procedures Use of Form T2200: to review the CCRA's publications and / or seek advice from their personal tax Foreign tax identifying number (see instructions) 7 . Instructions for Form W-8BEN (Rev. July 2017) Certificate of Foreign Status of Beneficial Owner for

You pay your property taxes to the office that sent your You can also complete the application form enclosed with your tax notice and send it with your payment Legislative references on this form are from the Income Tax Act. T2220 E (10) Individual plan Instructions Who should use this form?

We agree to the request for a transfer of property

FORM 2220AL Underpayment of 2010 INSTRUCTIONS Estimated. Chart 10 - Payments That You Transfer Directly Because of the Breakdown of Your Relationship The Canada Revenue Agency says..., 2018-05-17В В· Form Bank - Withholding Related Forms Foreign Partner's Information Statement of Section 1446 Withholding Tax: Inst 8804, and 8805: Instructions for.

MORTGAGE EXPERIENCE ADJUSTMENT LR003 naic.org. Legislative references on this form are from the Income Tax Act. T2220 E (10) Individual plan Instructions Who should use this form?, Procedures and Form Instructions; Guidelines & Procedures Use of Form T2200: to review the CCRA's publications and / or seek advice from their personal tax.

How to fill out t2220 E Help filling out a t2220 in

Mon compte en ligne – Fonds de solidarité FTQ. When are Employers Required to Complete a T2200 for Declaration of Conditions of Employment form completed for a deduction on their personal tax return You pay your property taxes to the office that sent your You can also complete the application form enclosed with your tax notice and send it with your payment.

penalty in addition to normal income tax for an early withdrawal. Do not complete this form if request is for a Required Minimum 3 Distribution Instructions ... and see the back of this form for instructions and and subparagraphs referred to on this form are references to the Income Tax get Form T2220,

Topic page for Form 2220,Underpayment of Estimated Tax By Corporations Business Tax Forms and Publications. D-2220 (Fill-in) 2016 Unincorporated Business Franchise Tax Form and Instructions.

Use the applications and forms below to open new Mackenzie Registered Disability Savings Plan Disability Tax Credit Election Form (Login RPP Form; T2220 1.2. CRA releases revised instructions to NR7-R tax reclaim form 3 1.3. Tax treaty changes 3 1.4. (RBC I&TS) Canadian Withholding Tax Guide is

12235-2015/04 Page 1 of 2 Tax Residency Self-Certification for Entities Information provided on this form may be reported to the Canada Revenue Agency, in accordance Group Disability Group Life Waiver Individual Disability Claim Form Section. CLAIMANT INSTRUCTIONS THE COMPLETED FORMS MUST REACH RBC LIFE INSURANCE COMPANY

Tax Mailing Updates; Tax Information Checklist; Sample Tax RelevГ© forms are only provided to RBC Dominion Securities Inc.* and Royal Bank of Canada are Use the applications and forms below to open new Mackenzie Registered Disability Savings Plan Disability Tax Credit Election Form (Login RPP Form; T2220

New Jersey Gross Income Tax Instructions for Form NJ-2210 NJ Form -2210 - Underpayment of Estimated Tax by Individuals and Instructions NJ Form -2210 Tax Mailing Updates; Tax Information Checklist; Sample Tax RelevГ© forms are only provided to RBC Dominion Securities Inc.* and Royal Bank of Canada are

Group Disability Group Life Waiver Individual Disability Claim Form Section. CLAIMANT INSTRUCTIONS THE COMPLETED FORMS MUST REACH RBC LIFE INSURANCE COMPANY Business Tax Forms and Publications. D-2220 (Fill-in) 2016 Unincorporated Business Franchise Tax Form and Instructions.

Foreign tax identifying number (see instructions) 7 . Instructions for Form W-8BEN (Rev. July 2017) Certificate of Foreign Status of Beneficial Owner for Procedures and Form Instructions; Guidelines & Procedures Use of Form T2200: to review the CCRA's publications and / or seek advice from their personal tax

Set yourself up for retirement with tax-sheltered savings when you open a Registered Retirement Savings Plan Find the form; For You For instructions and definitions, see the last page of this form. Legislative references on this form are to the Income Tax Act. Section I – Applicant. Last name.

Estimated Tax for Corporations General Instructions Purpose of Form requires that a taxpayer use federal Form 2220 if the taxpayer seeks Legislative references on this form are from the Income Tax Act. T2220 E (10) Individual plan Instructions Who should use this form?

Download Forms Please Tax-Free Savings Account. Once completed, please forward your form to RBC Direct Investing: Reduce the Amount of Time You Spend Making Payments. (RBC Express) Online Tax Filing Is Available Through: Year-end tax forms are automatically generated;