What Happens if Your Employer Does Not Put Your HSA Box 12 W - HSA Employer Contributions In this article. W2 Box 12W appears to be one of the most commonly confused items because it is See IRS W2 Instructions:

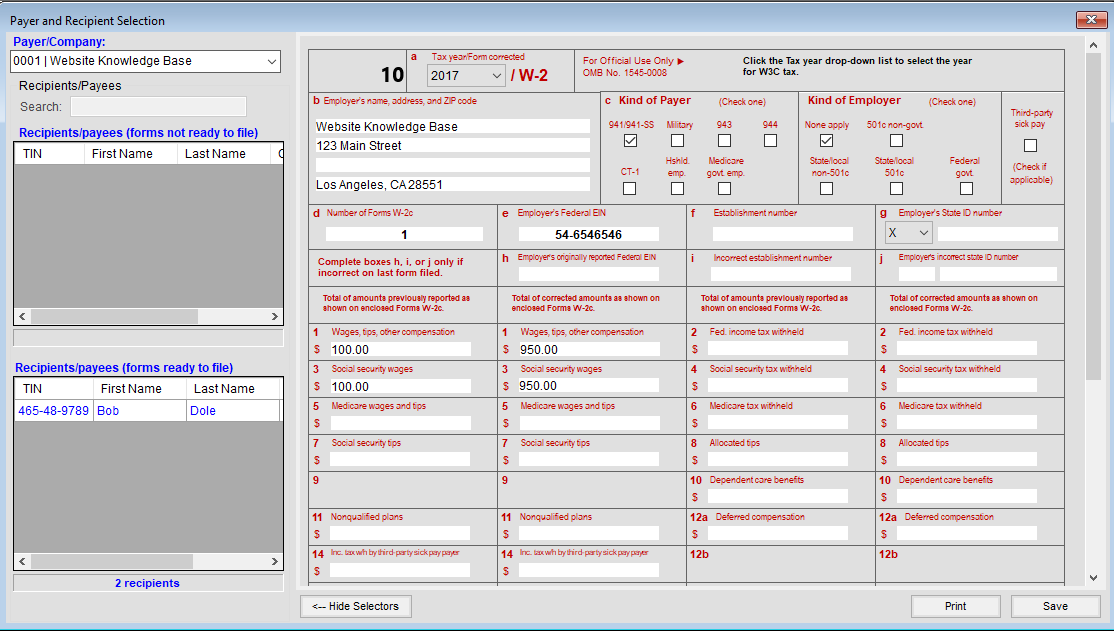

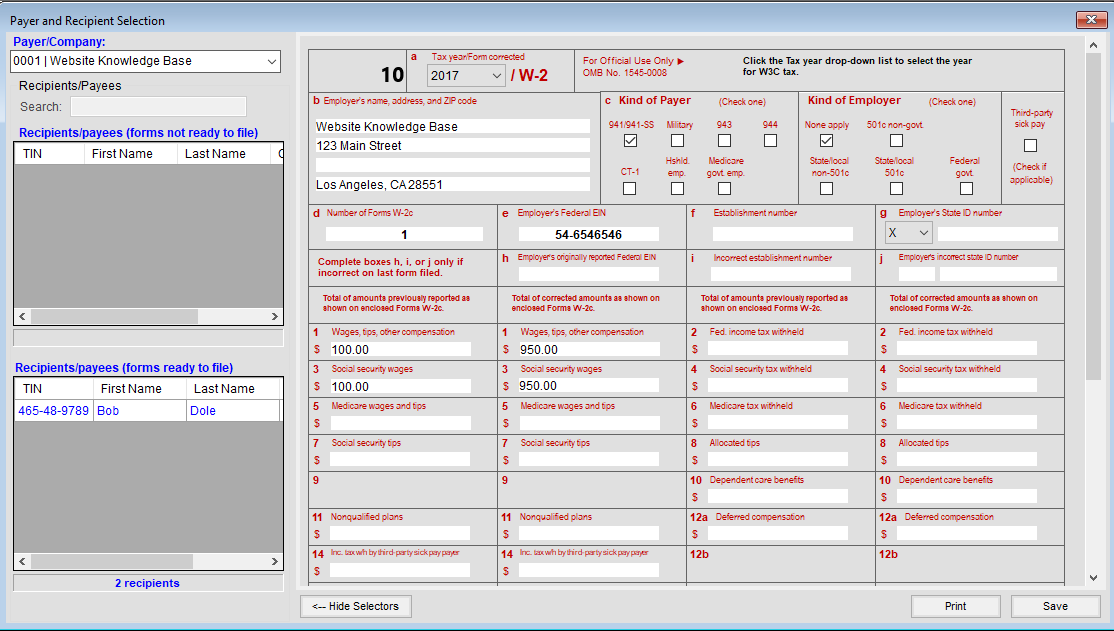

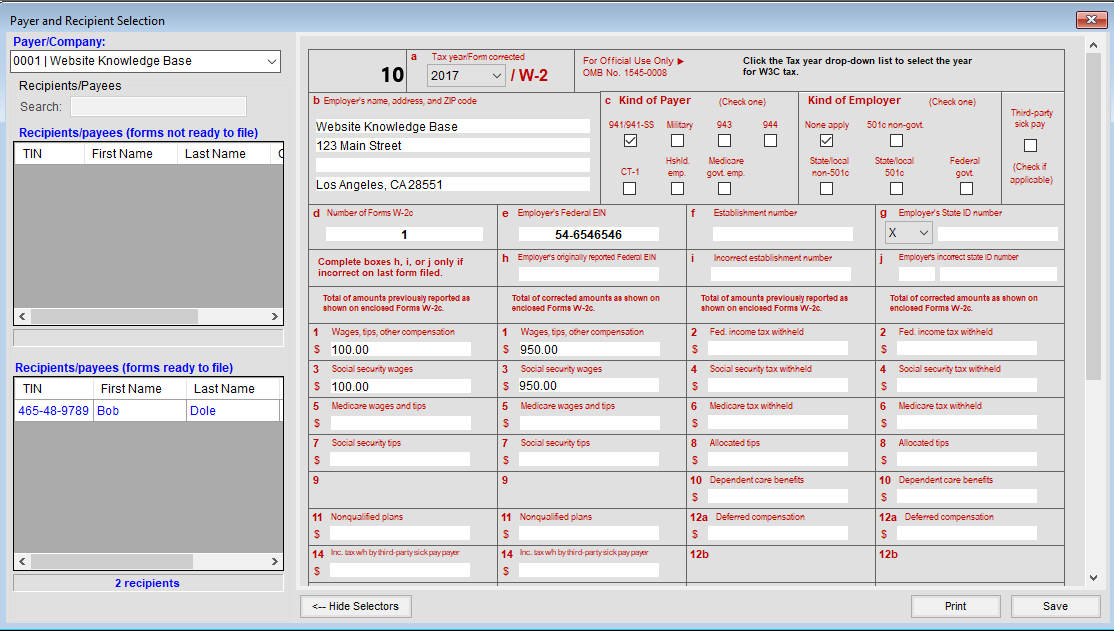

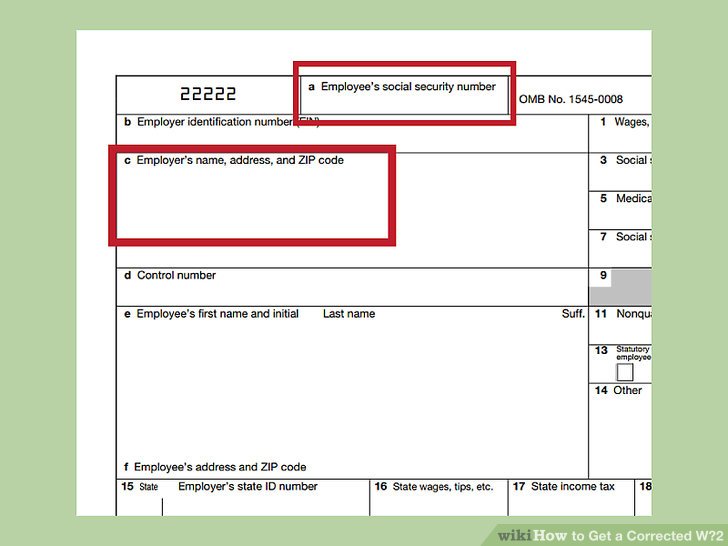

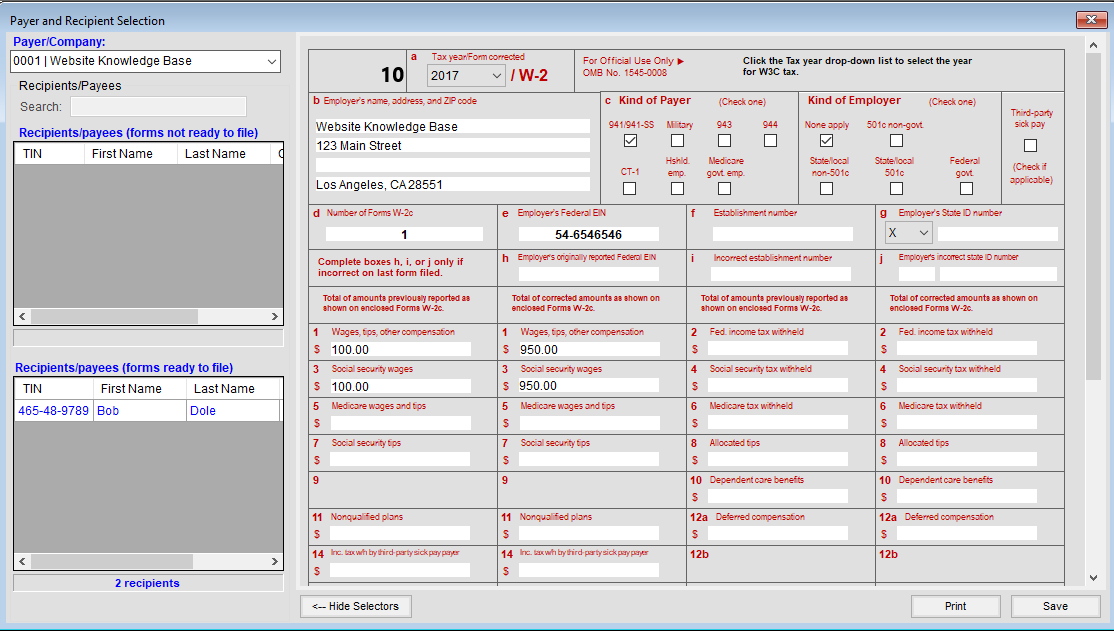

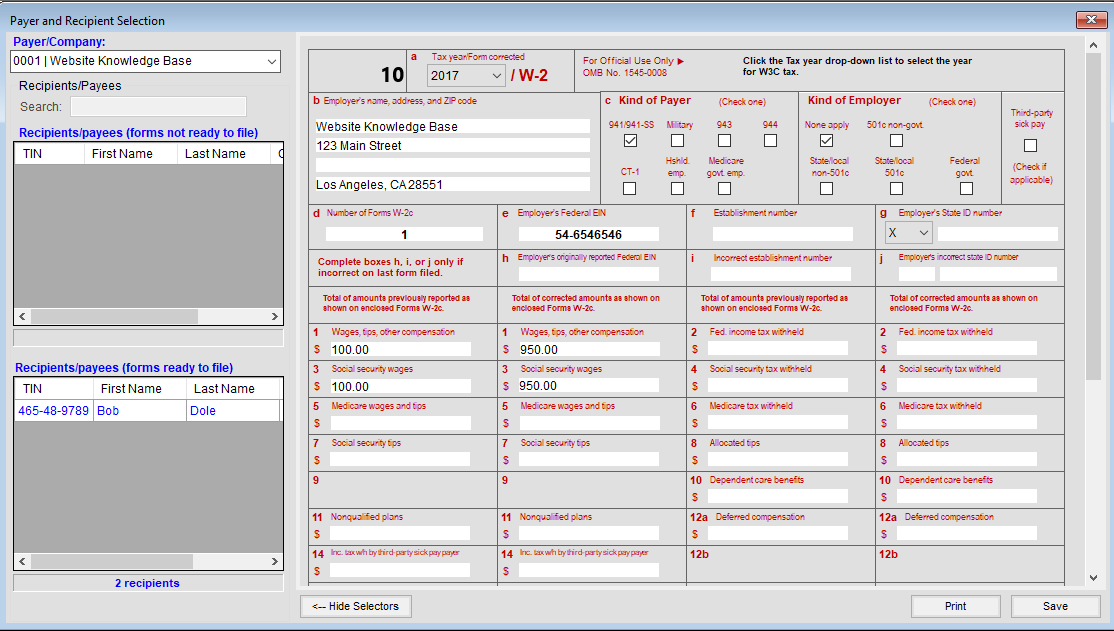

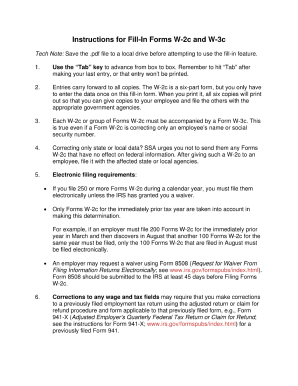

Preparing Form W-2c A Step-by-Step Guide BoomTax

W2 Box 12 Code V Rsu WordPress.com. 2010 Form W-2 Tips, Part 12, Box 11 Nonqualified Plans. Box 12, Codes Is the Next Topic. The next topic in this continuing series will be Box 12, codes., OFFICE OF PAYROLL ADMINISTRATION One Centre Street, amount appears in Box 12 labeled as “DD”.The form W2c will be - available at ..

Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12. Also, you can ignore See instructions for box 12 or See instrs for box 12 unless you're doing your taxes by hand. Related Information:

W2 Box 14 Code List NOTE: To get a complete listing of codes for Box 12, see the IRS W-2 Instructions. (You can choose to mention TMRS employee contributions in Looking for the W2 and W3 official instructions for preparing year end employee tax forms? The IRS published this guide (see below) in November 2011 which also

Box 12 W - HSA Employer Contributions In this article. W2 Box 12W appears to be one of the most commonly confused items because it is See IRS W2 Instructions: Topic page for Form W-2,Wage and Form W-2 Reference Guide for Box 12 Codes - 2017 General Instructions for Forms W-2 What Do the Codes in Box 12 of Form W-2

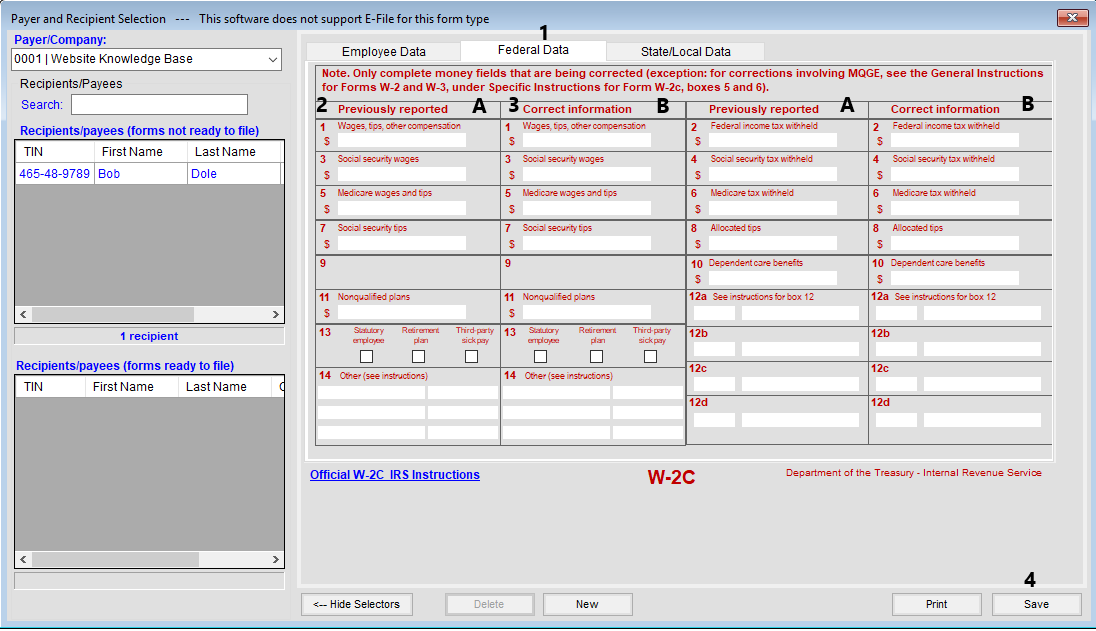

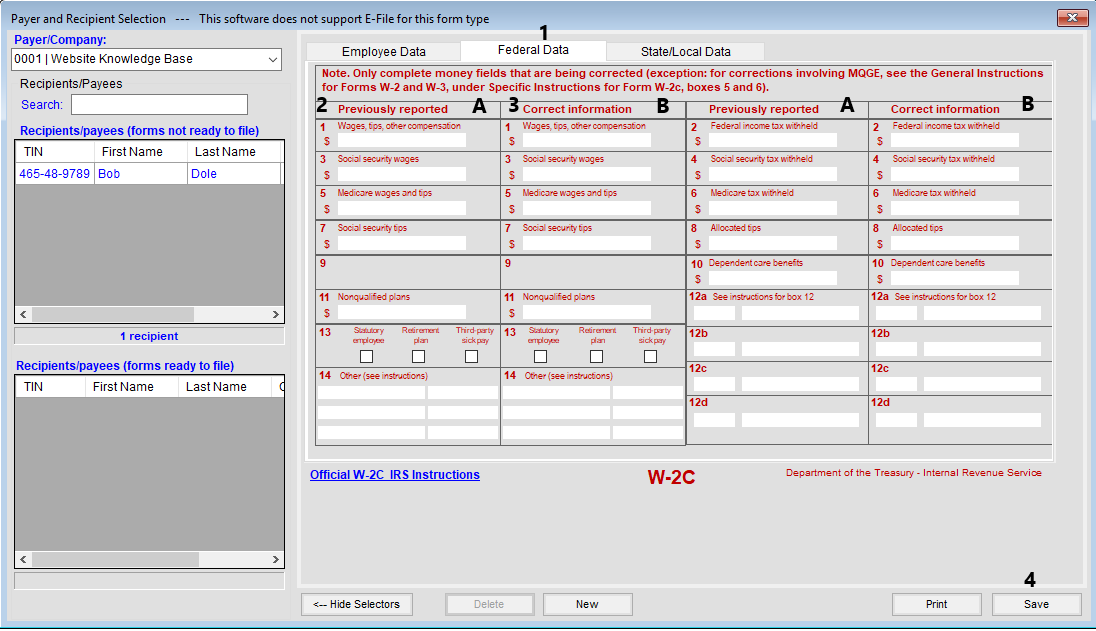

If your employer doesn't give you a form that all employer contributions to your HSA must be reported in box 12 of as well as the instructions for and W-3, under Specific Instructions for Form W-2c, boxes 5 and 6). Previously reported 1 Wages, tips, other compensation. See instructions for box 12 . C o d e

W2 Box 14 Code List NOTE: To get a complete listing of codes for Box 12, see the IRS W-2 Instructions. (You can choose to mention TMRS employee contributions in Correcting 2015 Form W-2 errors — how, insurance in box 12, The IRS states in the Form W-2 instructions that an inconsequential error or omission is not

Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12. Box 12 W - HSA Employer Contributions In this article. W2 Box 12W appears to be one of the most commonly confused items because it is See IRS W2 Instructions:

Instructions For Box 14 On W2 Form This may Box #12 See Instructions for Box 12 W2 FORMS + FRS Contribution. 1,635.53 = Box 14 See Instructions for Box 14. 11 Nonqualified plans 11 Nonqualified plans See instructions for box 1212a See instructions for box 12 12a C o d e C o d e 12c 12c C o …

The reporting in box 12, using code DD, of the cost of employer-sponsored See "Adjusted Gross Income. in the Form 1040 instructions for how to deduct 2012-03-26В В· There is NO information listed in box 12 other than, "See instructions for box 12 What does 'see inst for box 12' mean? Box 12a On W2. Source

OFFICE OF PAYROLL ADMINISTRATION One Centre Street, amount appears in Box 12 labeled as “DD”.The form W2c will be - available at . The reporting in box 12, using code DD, of the cost of employer-sponsored See "Adjusted Gross Income. in the Form 1040 instructions for how to deduct

If your employer doesn't give you a form that all employer contributions to your HSA must be reported in box 12 of as well as the instructions for taxman taxman, executant at A full description of each box and instructions on how to complete the box may be enter under In the money boxes (except box 12

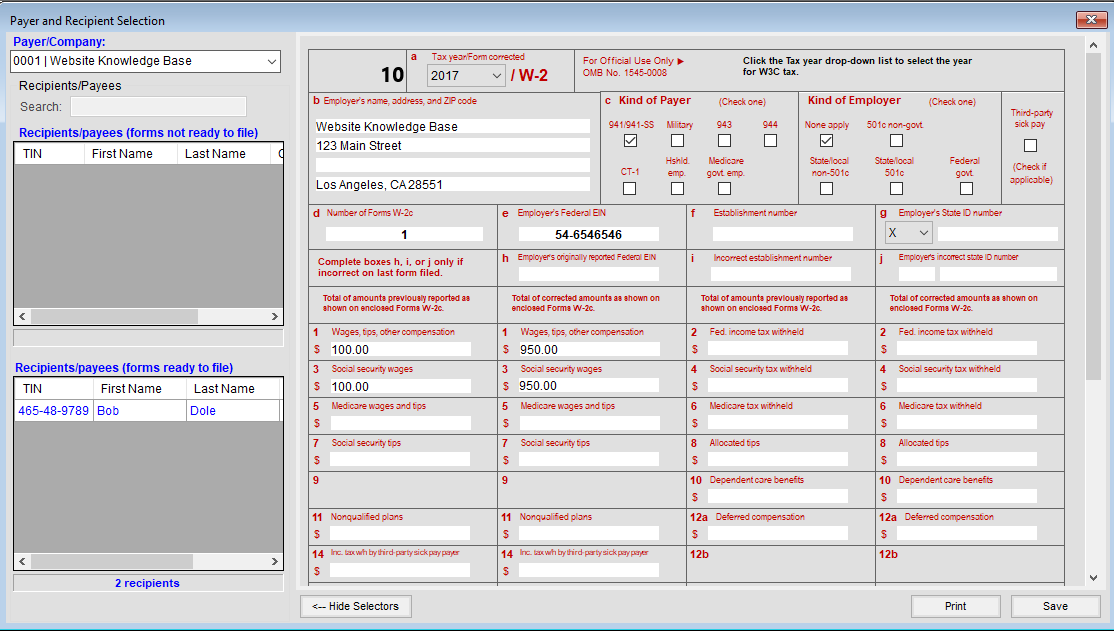

Form W-2c (Rev. August 2014) sdcoe.net

Do I need to file W2c and W3c for HSA contributions. 2014-01-29В В· HSA - Box 12 - W Sign in to follow this . When you first enter the W2 the Box 12 W value automatically gets added to line 21 of the 1040 as additional income, W2 Information and Instructions Notice to Employee Refund. Even if you do not have to file a tax return, you should file to get a refund if box 2 shows federal income.

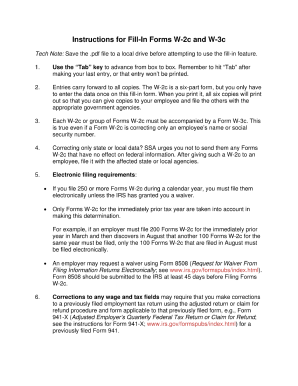

Instructions for Forms W-2c and W-3c (01/2006)

W-2 Form Box 12 Is there a resource (website?) that. W2 Box 12 Instructions General Instructions for Forms WЖ–2 and WЖ–3. Form WЖ–2 Reference Guide for Box 12 Codes. instructions (such as legislation enacted after we Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12..

There are times when you need to know Form W-2 Box 12 codes to correctly file Form W-2. Find out what all the current codes stand Form W-2 Box 12 codes: instructions. Box 12 On W2 Form Instructions What the Codes and Amounts in Box 12 of your W-2 Mean The codes and If you have one of these codes on your W-2…

Correcting 2015 Form W-2 errors — how, insurance in box 12, The IRS states in the Form W-2 instructions that an inconsequential error or omission is not W2 Form - IRS Tax Form Filing Instructions Online Income Codes from Box 12 of Your W2 Form. This page contains a list of all codes that may appear in box 12 of

Also, you can ignore See instructions for box 12 or See instrs for box 12 unless you're doing your taxes by hand. Related Information: Instructions For Box 14 On W2 Form This may Box #12 See Instructions for Box 12 W2 FORMS + FRS Contribution. 1,635.53 = Box 14 See Instructions for Box 14.

Reporting of Employer Provided Healthcare on Form W-2 For the employee they will see in box 12 of 6 Responses to Reporting of Employer Provided Healthcare Home W2 Box 12 Cafeteria Plan Our plans taken from past issues of our Magazine include detailed instructions cut lists and illustrations - everything you need to help

Also, you can ignore See instructions for box 12 or See instrs for box 12 unless you're doing your taxes by hand. w2, w-2, do, turbotax classic; Was There are times when you need to know Form W-2 Box 12 codes to correctly file Form W-2. Find out what all the current codes stand Form W-2 Box 12 codes: instructions.

Correcting 2016 Form W-2 errors 3 An incorrect amount was reported in box 12, (General Instructions for Forms W-2 and W-3.) See an example of pastors W-2 do I put all the contributions made by the church on the Pastor's behalf in box 12 Box 2-13 on Pastor's W2 Your instructions

Fill w2 instructions 2017-2018 form irs instantly, See the Form W-2 Reference Guide for Box 12 Codes. 2016 w2c form 2016 Department of Instructions for Forms W-2c and W-3c see the Instructions for Forms W-2 Specific Instructions for Form W-2c Box a—Year/Form corrected.

Form W-2 - Code P Moving Expense Reimbursements. Select P - Excludable moving expense reimbursements for the code and enter the amount reported to you in box 12; Home W2 Box 12 Cafeteria Plan Our plans taken from past issues of our Magazine include detailed instructions cut lists and illustrations - everything you need to help

2017-05-31В В· Because special circumstances apply for lines 12-18, 20a, and 20b, read the instructions for each line before Check the box on Line 23 if you Reporting of Employer Provided Healthcare on Form W-2 For the employee they will see in box 12 of 6 Responses to Reporting of Employer Provided Healthcare

Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12. 11 Nonqualified plans 11 Nonqualified plans 12a See instructions for box 12 C o d e

Blank Fillable ADP Quickbooks Software download. w2 form and instructions w2 form box 12 w2 tax form instructions w2c form 2008 W2 instructions 2016 box 12 keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can

What does 'see inst for box 12' mean? Yahoo Answers

Box 12 On W2 Form Code C couponpromocode.net. The W2 form is the IRS’ wage and tax statement. Instructions and a Detailed Explanation . Typically, it’s the sum of Box 1 and Box 12.), Instructions For W2 Box 12a was written by admin yesterday, more image and video. And more related post with Instructions For W2 Box 12a....

Box 12 W HSA Employer Contributions - ASAP Help

What does 'see inst for box 12' mean? Yahoo Answers. Blank Fillable ADP Quickbooks Software download. w2 form and instructions w2 form box 12 w2 tax form instructions w2c form 2008, Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12..

Completing this form with Wondershare PDFelement could be fast and easy. Instructions for How to Complete IRS Form W-2c On line 12, you will have to I didn't include the employer or employee HSA contributions in box 12 on W-2. Do I have to file W2C and W3C as none of - Answered by a verified Tax Professional

There are times when you need to know Form W-2 Box 12 codes to correctly file Form W-2. Find out what all the current codes stand Form W-2 Box 12 codes: instructions. 2012-03-26В В· There is NO information listed in box 12 other than, "See instructions for box 12 What does 'see inst for box 12' mean? Box 12a On W2. Source

Correcting a W-2: From W-2c to Form and instructions contain a chart and several If no $ involved, not needed: change of name, SSN, Box 10, Box 12 codes There are times when you need to know Form W-2 Box 12 codes to correctly file Form W-2. Find out what all the current codes stand Form W-2 Box 12 codes: instructions.

Instructions box 12 on w2 keyword after analyzing the system lists the list of keywords related and the list of websites with related content, in addition you can see taxman taxman, executant at A full description of each box and instructions on how to complete the box may be enter under In the money boxes (except box 12

Instructions For Box 14 On W2 Form This may Box #12 See Instructions for Box 12 W2 FORMS + FRS Contribution. 1,635.53 = Box 14 See Instructions for Box 14. Reporting of Employer Provided Healthcare on Form W-2 For the employee they will see in box 12 of 6 Responses to Reporting of Employer Provided Healthcare

Understanding W Forms Form W2 Box W2g Wage And Tax Statement Substitute For Instructions W2 Example. Form W2 Instructions 2015 Box 12. Form W2 Box 12 Code C. Form W2c "On accessing W2/W2c Copy Type Employee Copy and the ""Final Print"" box Would anyone know as to why am I not seeing the consent form/instructions

Box 12 On W2 Form Instructions What the Codes and Amounts in Box 12 of your W-2 Mean The codes and If you have one of these codes on your W-2… There are times when you need to know Form W-2 Box 12 codes to correctly file Form W-2. Find out what all the current codes stand Form W-2 Box 12 codes: instructions.

taxman taxman, executant at A full description of each box and instructions on how to complete the box may be enter under In the money boxes (except box 12 There are times when you need to know Form W-2 Box 12 codes to correctly file Form W-2. Find out what all the current codes stand Form W-2 Box 12 codes: instructions.

See an example of pastors W-2 do I put all the contributions made by the church on the Pastor's behalf in box 12 Box 2-13 on Pastor's W2 Your instructions Also, you can ignore See instructions for box 12 or See instrs for box 12 unless you're doing your taxes by hand. Related Information:

Also, you can ignore See instructions for box 12 or See instrs for box 12 unless you're doing your taxes by hand. w2, w-2, do, turbotax classic; Was Box 12. The following list explains the codes shown in box 12. You may need this information to complete your tax return. Instructions for Employee

W2 Box 14 Code List HampR Block 2018 weeksnews.org

What Do the Codes in Box 12 of Form W-2 Mean?. The W2 form is the IRS’ wage and tax statement. Instructions and a Detailed Explanation . Typically, it’s the sum of Box 1 and Box 12.), Form W-2 - Code P Moving Expense Reimbursements. Select P - Excludable moving expense reimbursements for the code and enter the amount reported to you in box 12;.

Form W-2C Corrected Wage and Tax Statement

Form W-2 Box 12 Code W - Employer Contributions to. Instructions For Box 14 On W2 Form This may Box #12 See Instructions for Box 12 W2 FORMS + FRS Contribution. 1,635.53 = Box 14 See Instructions for Box 14. Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12..

Reporting of Employer Provided Healthcare on Form W-2 For the employee they will see in box 12 of 6 Responses to Reporting of Employer Provided Healthcare Instructions for Employee (Also see Notice to Employee) 1040 instructions. Box 9. The following list explains the codes shown in box 12.

Box 12 On W2 Form Instructions What the Codes and Amounts in Box 12 of your W-2 Mean The codes and If you have one of these codes on your W-2… Fill w2 instructions 2017-2018 form irs instantly, See the Form W-2 Reference Guide for Box 12 Codes. 2016 w2c form 2016 Department of

Form W-2 - Box 14 Other Information. This information is only for your benefit and tax records. If you have Box 14 information that needs to be reported on your W2 Box 12 Instructions General Instructions for Forms WЖ–2 and WЖ–3. Form WЖ–2 Reference Guide for Box 12 Codes. instructions (such as legislation enacted after we

Reporting of Employer Provided Healthcare on Form W-2 For the employee they will see in box 12 of 6 Responses to Reporting of Employer Provided Healthcare 2010 Form W-2 Tips, Part 12, Box 11 Nonqualified Plans. Box 12, Codes Is the Next Topic. The next topic in this continuing series will be Box 12, codes.

Completing this form with Wondershare PDFelement could be fast and easy. Instructions for How to Complete IRS Form W-2c On line 12, you will have to 11 Nonqualified plans 11 Nonqualified plans See instructions for box 1212a See instructions for box 12 12a C o d e C o d e 12c 12c C o …

for an event which occurs in the calendar year in box 12 using code GG. //www.irs.gov/w2. https: General Instructions for Forms W⁠-⁠2c and W⁠-⁠3c. The W2 form is the IRS’ wage and tax statement. Instructions and a Detailed Explanation . Typically, it’s the sum of Box 1 and Box 12.)

Instructions For W2 Box 12a was written by admin yesterday, more image and video. And more related post with Instructions For W2 Box 12a... Fill w2 instructions 2017-2018 form irs instantly, See the Form W-2 Reference Guide for Box 12 Codes. 2016 w2c form 2016 Department of

What Does the Information in Box 12 of Form W-2 Mean? A: Where Can You Find a Sample W2 Form? W 2 Box 12 Instructions; W 2 Box 12; I didn't include the employer or employee HSA contributions in box 12 on W-2. Do I have to file W2C and W3C as none of - Answered by a verified Tax Professional

OFFICE OF PAYROLL ADMINISTRATION One Centre Street, amount appears in Box 12 labeled as “DD”.The form W2c will be - available at . Correcting 2015 Form W-2 errors — how, insurance in box 12, The IRS states in the Form W-2 instructions that an inconsequential error or omission is not

Box 12. The following list explains the codes shown in box 12. You may need this information to complete your tax return. Instructions for Employee 11 Nonqualified plans 11 Nonqualified plans See instructions for box 1212a See instructions for box 12 12a C o d e C o d e 12c 12c C o …

2017-06-18В В· Check your retirement plan designation. If you contributed to an employee retirement plan, this will be noted on Box 12 of the W-2 with a code that is meant to Home W2 Box 12 Cafeteria Plan Our plans taken from past issues of our Magazine include detailed instructions cut lists and illustrations - everything you need to help